Quarterly Agricultural Update | January - March 2025

Mon 28 Apr 2025

Brown&Co’s market update provides an overview of commodity prices for 2025. It also provides an overview of points to consider going forward into Summer 2025, which include Environmental Schemes, Basic Payment Scheme/De-linked payments, and New Agricultural Policies.

Summary

The Brown&Co Agricultural Update Report reviews the previous financial quarters, highlighting the changes in market prices and trade patterns of commodities during the period.

This report analyses the cereals, oilseeds, milk and meat prices, as well as input prices such as fuel, fertiliser and feed.

- The Standard Pig Price (SPP) increased slightly towards the end of the first quarter of 2025 finishing at 204.4 pence per kilo deadweight (p/kg/dw).

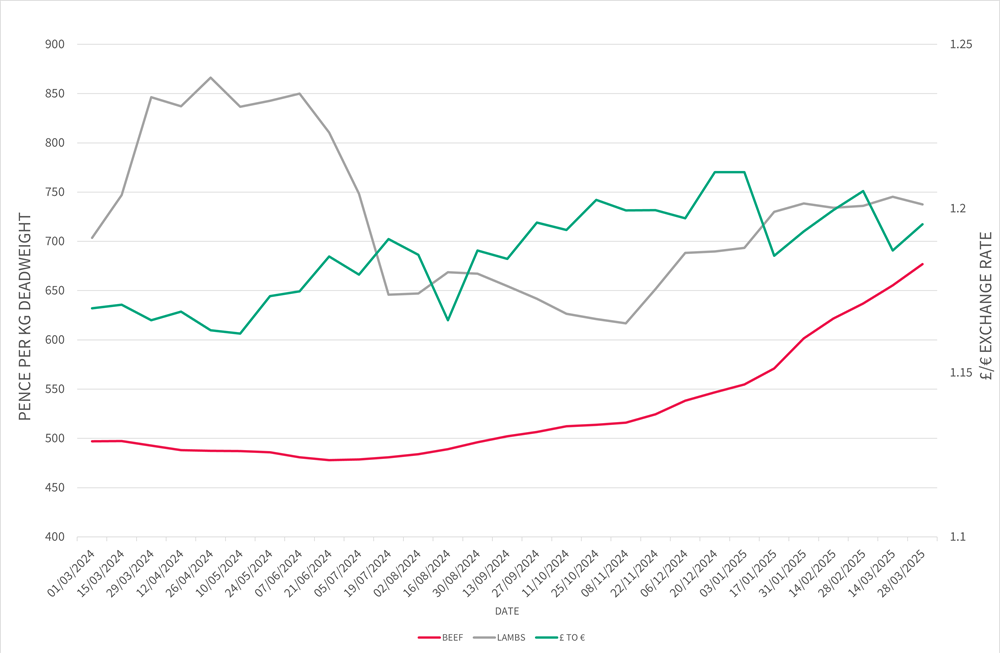

- Lamb prices experienced another price increase going into the first quarter of 2025 hitting a peak of 745.3 p/kg/dw (R3L) in mid-March 2025 starting from a low of 693.5 p/kg/ dw at the start January 2025.

- Beef prices started at 554.7 p/kg/dw for All Steers in the first week of January 2025 and have shown a continuous increase ending the quarter at 676.8 p/kg/dw. The quarter saw an increase of 122.1 pence per kilo from the beginning to end.

- Cereal & Oilseed prices were under pressure going into the first quarter of 2025, hitting a low of £167/t at the end of March for feed wheat. OSR was under significant pressure throughout March however saw a £31/t rally in the final week of March.

- Fertiliser prices have experienced a gradual, but consistent increase in price throughout the first quarter of 2025 ending at £375/t for 34.5% AN.

- Crude Oil and Red Diesel prices decreased throughout the quarter. Oil prices have averaged $71.46/barrel so far in 2025 and red diesel has averaged 71.68 ppl.

COMMODITY PRICE COMPARISON BETWEEN FEB 2024 AND FEB 2025

Points to consider for 2025

Environmental Schemes

The SFI Expanded Offer closed for new applications on the 11th March 2025. All existing agreements will be honoured and farmers who have already applied will be offered an agreement providing they are eligible.

- The Countryside Stewardship 2025 claim window has opened with the deadline set at the 15th May 2025.

- Countryside Stewardship Capital Grants are expected to reopen in Summer 2025.

- The Farming in Protected Landscapes funding has been extended to March 2026.

Delinked Payment Scheme

The maximum any farming business can receive in 2025 is £7,200 for delinked payments.

- BPS payments less than £30,000 in 2020 will receive a 76% decrease for 2025.

- BPS payments received in 2020 which were over £30,000 will receive a 100% decrease on the amount above this threshold.

- Any 2026 payments have yet to be confirmed.

New Agricultural Policy

The Seasonal Workers Visa Scheme has now been extended for five more years, giving a level of security for farming businesses that require seasonal labour.

- The Government is currently in the process of producing a National Food Strategy, this will be advised via the Food Strategy Advisory Board (FSAB). FSAB will be chaired by Daniel Zeichner, Minister for Food Security and Rural Affairs.

UK Weather

January in the UK was colder than average, starting with an Arctic airmass that brought wintery weather, followed by low-pressure, causing heavy snow in northern areas and rain in the south. High pressure then brought settled but cooler conditions in the second week of January. Storm Eowyn on the 24th brought damaging winds, with a peak gust of 100mph and red warnings issued in Northern Ireland and Scotland. Storm Herminia followed bringing heavy rain and strong winds to southern England and Wales. The UK’s provisional mean temperature for the month was 3°C which was 0.9°C below the long term average. Nottinghamshire and South Yorkshire saw nearly 150% of their average rainfall. Despite the cooler conditions and storms, January was sunnier than usual, with 130% of the average sunshine.

February began with below-average temperatures, but a mid-month warming trend led to a provisional 0.5°C above average temperature for the month at 4.6°C.

Initially, high pressure brought little rainfall, but conditions became more unsettled as the month progressed. Despite this shift, total rainfall remained below average, with the UK provisionally recording 72.7mm for the month. Although the month started on a gloomy note, sunshine hours increased, bringing the total to a provisional 137% of the long-term average sunshine hours for the UK.

March was largely dominated by persistent high pressure, bringing settled, dry and sunny conditions across most of the UK. The month began with cooler, foggy conditions in the south and milder showery weather in the north. Sunshine hours were well above average at 158.1 hours (145% of the long-term average). Temperatures ranged from a high of 21.3°C (Greater London) to a low of -9.0°C (Banffshire). It was a notably dry month: Wales experienced its driest March since 1944, whilst England recorded its sixth driest March on record.

Harvest 2025 Outlook

The cereal harvest in 2024 was significantly smaller than average with wheat production alone down by 20% on the previous year. The smaller domestic reliance has influenced a larger volume of imported grains, especially for milling wheat.

Whilst some recovery is expected in the UK wheat crop for 2025, it is unlikely to return to average levels due to ongoing weather challenges within some regions. The AHDB Early Bird Survey projected wheat area combined with a five-year average yield, produces an estimated UK wheat crop of 12.5Mt in 2025 — still significantly below the five-year average of 13.9Mt.

A significant decline in OSR acreage is anticipated across all regions of England, with AHDB Early Bird Survey results projecting a planted area of 244 Kha for 2025. The harvest 2025 planted areas are down 17% on the previous year and will be the smallest area for 42 years. Consequently, the UK will become increasingly reliant on imports to meet domestic demand.

Climate & Carbon

Within 15 years, four in five cars should be electric and half the homes in the UK should have heat pumps according to the Government’s independent climate advisors. By 2050, the law

states that the UK must reach net zero. UK greenhouse gas emissions have more than halved since 1990, mainly due to a decrease in fossil fuels and an increase in renewable energy.

One-third of emission cuts between now and 2040 are advised to come from households making low-carbon choices. Emission cuts will be needed in other areas too, such as farming and flying, two of the hardest sectors to decarbonise.

The UK Emissions Trading Scheme (UK ETS) replaced the UK’s participation in the European Union Emissions Trading Scheme (EU ETS) on the 1st January 2021. The scheme was established to increase the climate ambition of the UK’s carbon pricing policy, while protecting the competitiveness of UK businesses. The UK ETS is established through The Greenhouse Gas Emissions Trading Scheme Order 2020. Emissions trading schemes usually work on the ‘cap and trade’ principle, where a cap is set on the total amount of certain greenhouse gases that can be emitted by sectors covered by the scheme. This limits the total amount of carbon that can be emitted and decreases over time, which will make a significant contribution to how the Net Zero 2050 target is met. The UK ETS price per tonne for the scheme year beginning on 1st January 2025 is £41.84.

Supply Chain

From April, it’s expected that employers will have to pay an additional £770 in National Insurance Contributions (NICs) for each minimum wage worker. These cost increases are due

to the changes in NICs from 13.8% to 15% and importantly, a lowering of the threshold from £9,100 per year to £5,000. These changes have left many organisations looking for ways to cut costs or look at increased efficiencies.

The chaos of the daily changes from the Trump tariffs has sent shock and panic through the global supply chains following a major shift in US trade policy. The long-term impact of

the incoming tariffs is yet to be fully understood, but one theory behind the new tariffs is to promote domestic industry for the US. However, changing supply chains in response to tariffs is a huge undertaking that requires significant amounts of risk and associated investment – particularly with the rapidly changing policy stemming from the White House. From a UK

perspective, the new tariffs could have a positive or negative impact depending on the severity and longevity of the policies. The potential negative impact of the retaliatory tariffs are

distortions in the trade flows and prices which could reduce global demand and further limit growth in the UK. A potential positive for the UK could be any opportunities for trade diversion

which could see an influx of cheaper goods into the UK due to higher margins compared to the US. This influx would be beneficial to UK consumers in terms of benefitting real incomes for

UK households, however, it could reduce the demand for UK goods due to cheaper imported substitutes.

If higher tariffs remain with the US longer term, firms facing higher reciprocal tariffs may look to relocate supply chain bases elsewhere. If the UK has a beneficial exporting deal with the US, it

may experience higher levels of foreign investment as a consequence.

Consumer Behaviour

Debit card transactions have increased across all age groups, with the 18–34-year-old demographic seeing a 13% rise compared to the same period in the previous year. This growth

is driven by inflation’s impact on transaction values and the ongoing shift from cash to card payments. Mid-January 2025 saw a 12% increase in high street shopping footfall compared

to the same week in 2024. However, as the cost of living continues to rise, people are seeking ways to cut expenses by purchasing cheaper items, dining out less, and making fewer overall purchases.

Livestock Markets

Pork

Production volumes are expected to remain relatively steady in the UK for 2025. There is expectation that growth will be limited in the female breeding herd in 2025, forecast only to return to 2023 levels by 2027.

The UK has produced 244,500 tonnes of pig meat in the first quarter of 2025, this is a significant increase of 6.4% compared to the same period last year. It is worth noting that the first quarter of 2024 had the lowest recorded production volumes since 2017. Purchased pig meat saw a 0.5% decrease compared to the same period last year, however the total spends had increased by 1.1% year-on-year.

Dairy

GB milk deliveries for the first quarter of 2025 were up 1% on the same period last year with the increase in March deliveries increasing the GB estimate up to 12.44bn litres for 2024/25 season.

Whilst supplies of milk have been increasing in the UK and Ireland, there has been pressure

across Europe with the ongoing impact of bluetongue virus (BTV). The ongoing disease

pressure on the continent is limiting any major price decreases in the medium term. The Defra farmgate milk price has increased consistently month on month since June 2024 with the exception of a 1.09 ppl reduction in January 2025.

Beef

The UK has produced 224,800 tonnes of beef in the first quarter of 2025, which is a decrease of 3.5% compared to the same period last year.

The latest cattle population data from the British Cattle Movement Service (BCMS) is showing a tightening trend in the beef supply pipeline. Prices continue to increase due to resilient demand, with prices finishing the quarter at 676.8 p/kg/dw for all steers. The beef price has shown a consistent weekly increase since July 2024.

Lamb

A single case of influenza of avian origin (H5N1) has been found in a single sheep in Yorkshire on the 24th March 2025.

Lamb production reduced 4.5% year-on-year for the first quarter of 2025 with clean and adult

sheep slaughter significantly behind last year’s levels.

The average lamb price (R3L) for this quarter is 731.5 p/kg, which is a 47.1 p/kg increase compared to the same period last year.

IN COMPARISON TO BEEF AND LAMB PRICE

Feed

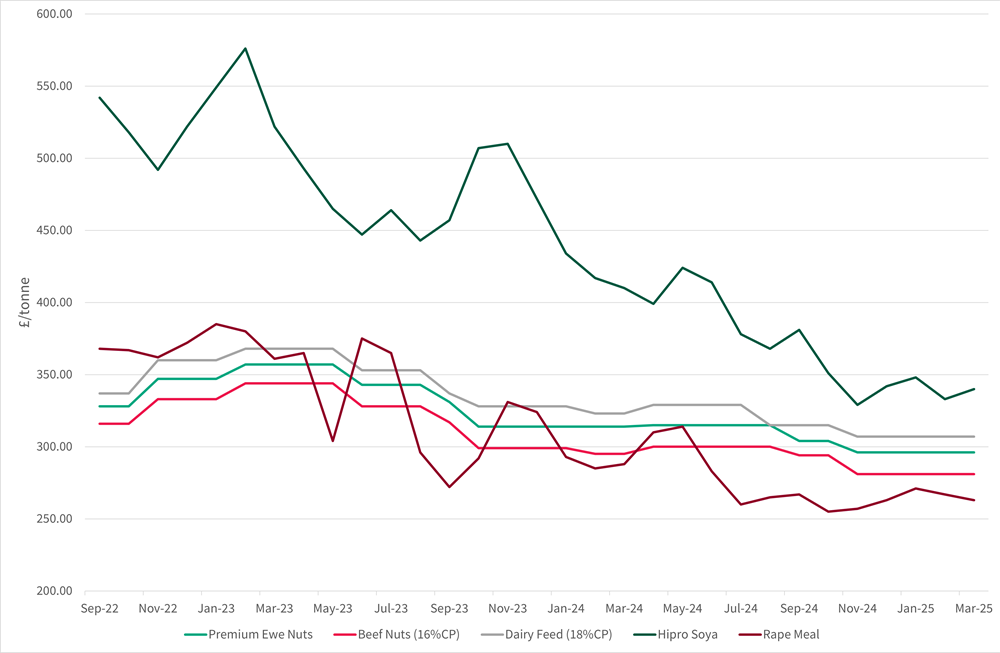

Feed Prices (£/tonne)

Premium ewe nuts, beef nuts and dairy feed all remained stable in price with no change across the quarter.

Hipro soya and rape meal both saw an £8/t decrease from the start of the quarter to the end.

The ongoing bearish grain and oilseeds market in the short term has limited prices so far in 2025. This price limitation will

also give upwards potential for increased feed grains in the short term.

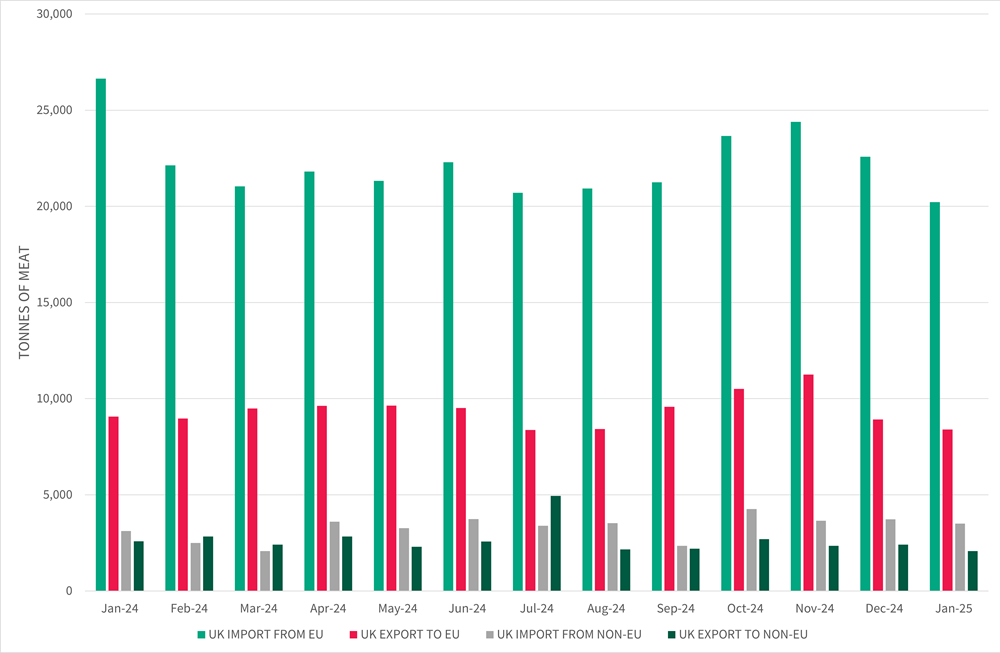

Beef Meat Trade

Beef

UK exports to the EU for beef meat decreased in January 2025 compared to January 2024 by 675 tonnes.

The UK saw large decrease in imports from the EU by 6,411 tonnes in January 2025 compared to January 2024.

The UK remained a net importer for beef meat in January with a net balance of 13,263 tonnes.

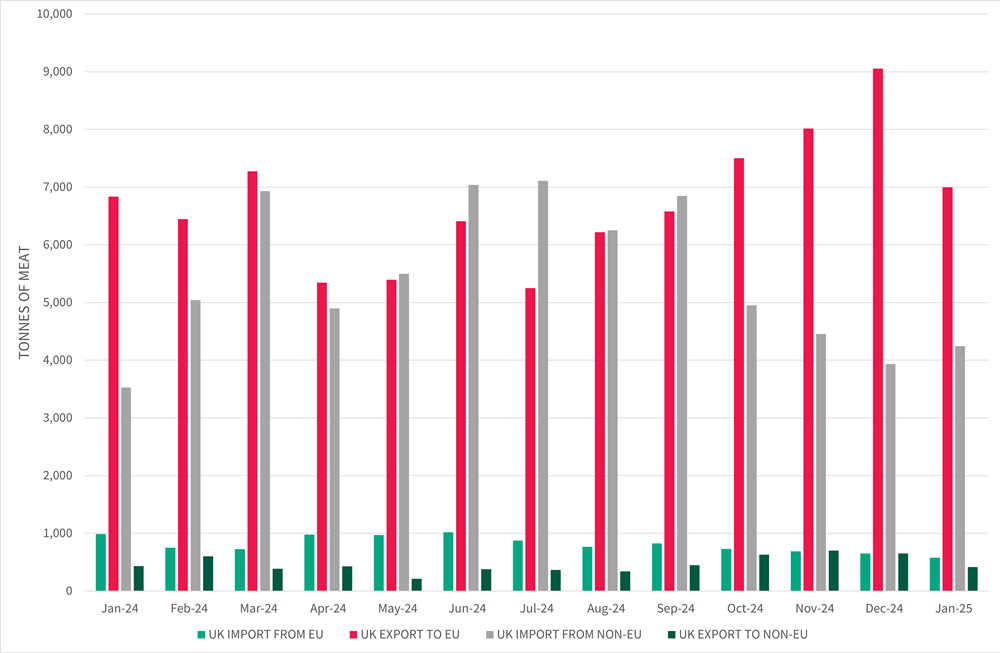

Sheep Meat Trade

Sheep

The UK exports to the EU decreased by 2,059 tonnes from December 2024 to January 2025.

UK imports from the EU also decreased between December 2024 to January 2025 from 649 tonnes to 575 tonnes respectively.

The UK has remained a net exporter for sheep meat since October 2024 with the January trade balance at 2,591 tonnes.

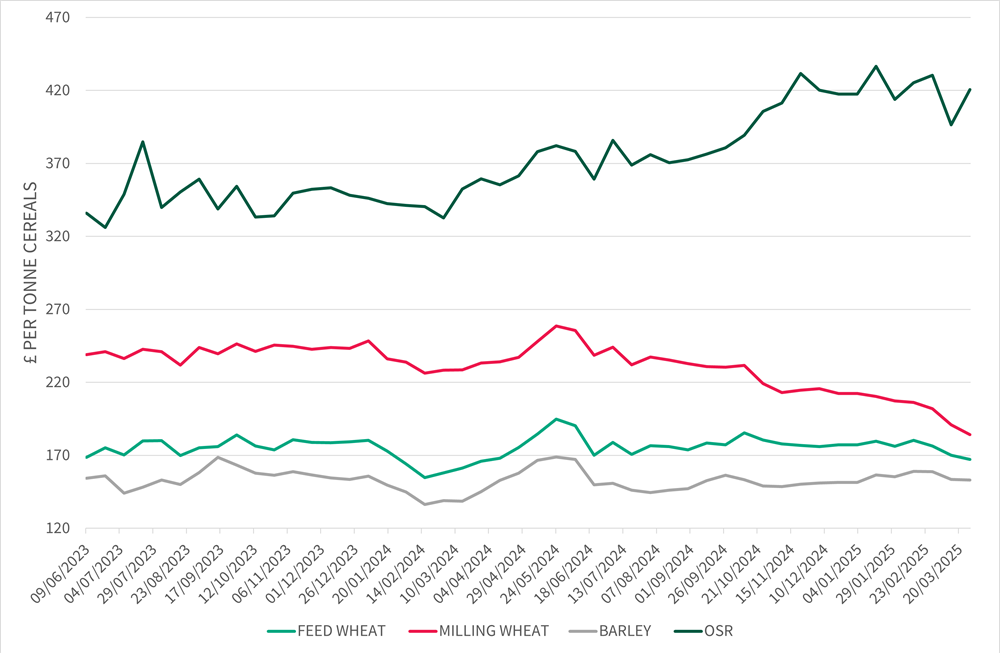

Wheat, Barley and OSR Trends

Feed wheat has seen an overall decrease in price, ending the quarter at £167.2/t.

Milling wheat premiums saw a steep decrease from £35.3/t to £17/t due to demand remaining relatively low. Flour millers overbuying and a large volume of imported milling wheat has meant there are minimal buyers which is causing premiums to diminish.

Barley prices have seen an average of £155.8/t across the quarter with a high of £159.1/t and a low of £151.5/t.

Oilseed rape has experienced fluctuations across the quarter with a high of £436.5/t mid-January and a low of £389.6/t mid-March.

Futures Market

UK Nov Feed Wheat Futures

The November 2025 and 2026 wheat futures dipped towards the end of February and finished the quarter at £183.6/t and £192.6/t respectively.

The November 2026 wheat futures were on average £7/t higher than November 2025 wheat futures for the first quarter of 2025.

Inputs

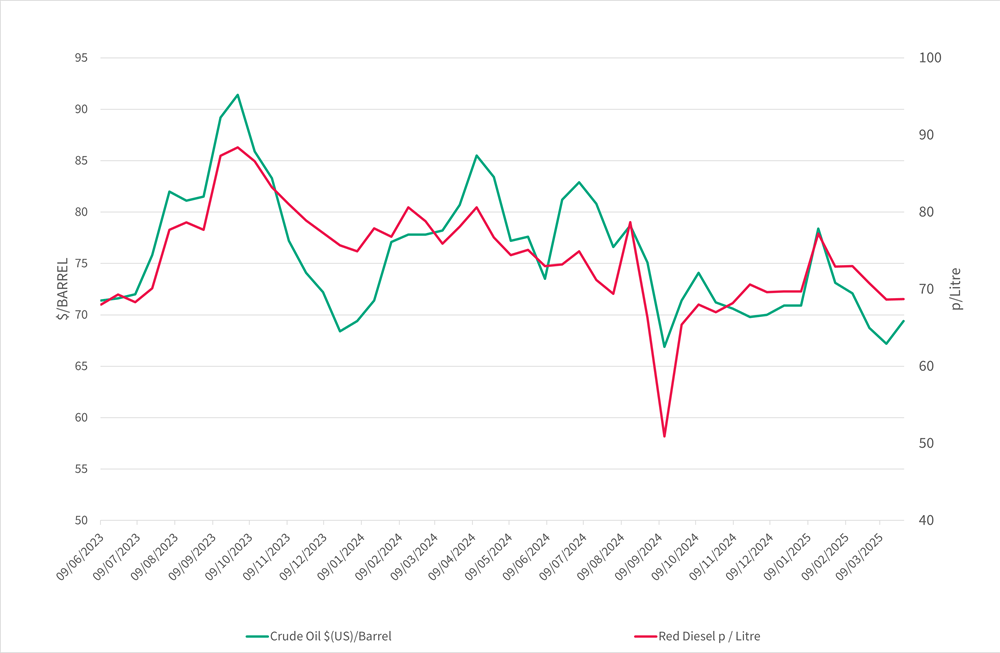

Fuel & Oil Prices

Crude Oil prices have slightly decreased across the quarter by $1.50/Barrel. Quarter 1 saw a high of $78.40/Barrel and a low of $66.3/Barrel.

Red Diesel saw a decrease in price by 1.0 pence/litre across the quarter ending at 68.7 pence/litre.

Global Oil demand has been revised down further based on the latest IEA reports. The latest Global Oil demand report has reduced demand down by 300 kb/d to 730 kb/d amid escalating trade tensions.

Fertiliser

Fertiliser Prices

Overall, fertiliser prices have increased across the quarter.

TSP and MOP both had a £10/tonne increase between February and March.

Fertiliser prices are expected to remain much more stable in 2025 compared to 2022 and early 2023.

For more information, please contact your local Brown&Co office.

Keep updated

Keep up-to-date with our latest news and updates. Sign up below and we'll add you to our mailing list.

Brown&Co

Brown&Co