Agricultural Update July – September 2025

Thu 16 Oct 2025

The Brown&Co Agricultural Update Report reviews the previous financial quarters, highlighting the changes in market prices and trade patterns of commodities during the period.

This report analyses the cereals, oilseeds, milk, and meat prices, as well as input prices such as fuel, fertiliser, and feed.

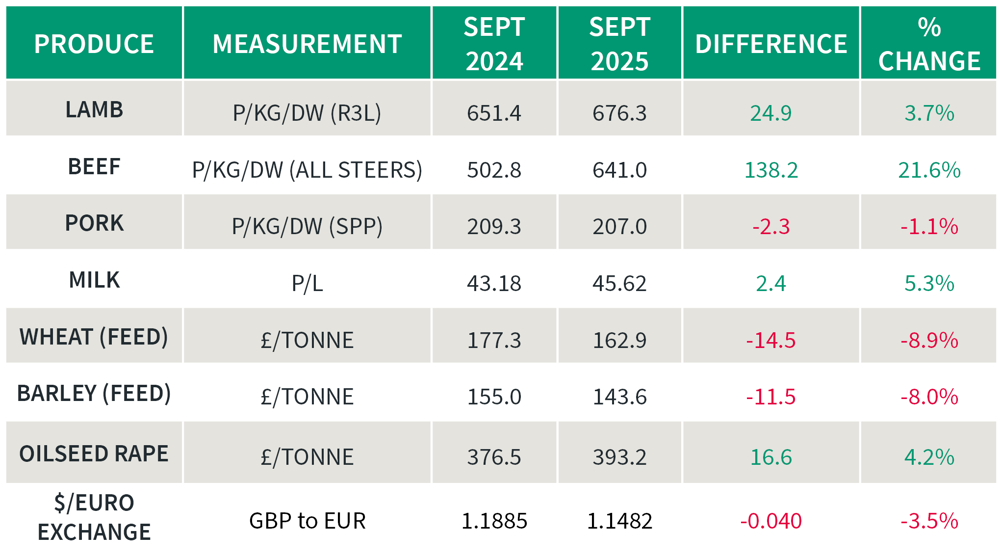

The Standard Pig Price (SPP) has remained largely stationary in quarter three, finishing at 206.7 pence per kilo deadweight (p/kg/dw) compared to 207 p/kg/dw at the end of the previous quarter.

Defra farmgate milk prices have increased this quarter and averaged 45.62 pence per litre (ppl) in August 2025, an increase of 2.39ppl since the close of the previous quarter (June 2025).

Lamb prices experienced a decrease in price over quarter three, hitting a low of 662.5p/kg/dw (R3L) in mid-September 2025, an overall decrease of 76p/kg/dw from the end of the last quarter.

The falling beef prices for All Steers has stabilised throughout this quarter, with an overall increase in price, ending the quarter at 641.50p/kg/dw, compared to opening the quarter at 633.80p/kg/dw.

Cereal & Oilseed markets have shown small price fluctuations, the feed wheat price has increased by £2.80/tonne over the quarter, ending at £162.40/tonne. Milling wheat price has seen an overall decrease in price, with more variability than feed wheat, ending the quarter at £178.70/tonne, with a milling premium of £16.30/tonne, with a premium peak of £29.40/tonne in mid-July. Oilseed rape has also experienced fluctuations across the quarter, closing the quarter at £399.70/tonne, a small change from the end of the previous quarter at £400.70/tonne.

Overall, fertiliser prices have increased over the quarter. 34.5%AN started and ended the quarter at £390/tonne. 0-24-24 has increased by £20/tonne. In the same period TSP has increased by £15/tonne to £530/tonne and MOP increased by £5/tonne, ending the quarter at £370/tonne.

Crude Oil prices have relatively remained the same, increasing by $0.15/Barrel throughout the quarter. Red diesel saw a decrease of 1.37pence/litre across the quarter ending at 68.60pence/litre.

COMMODITY PRICE COMPARISON BETWEEN SEPTEMBER 2024 AND 2025

Note: Due to the dynamic period we are currently in, commodity prices may move daily.

POINTS TO CONSIDER FOR 2025

Environmental Schemes

The Countryside Stewardship Capital Grant 2025 Scheme opened on 3rd July; a new round making £150 million of funding available to rural businesses for practical environmental improvements across England.

The scheme offer comprised of 78 items available including planting hedgerows, managing boundaries, improving water and air quality, restoring habitats and introducing natural flood management measures. There were funding limits of £25,000 for each of: water quality, air quality and natural flood management and £35,000 limit for boundaries, trees and orchards. On 31st July, capital grants were closed due to all funding being allocated. Further improvements are set to be made to the offer and the RPA ‘expect’ to open a new round for farmers to secure more funding during 2026.

The SFI 2024 offer re-opened on 7th July, for those who had started their SFI application, but had not submitted. Applications could be made during a 6-week window, closing on 18th August. The agreement value was restricted to £9,300 per annum, excluding the SFI management payment.

On 11th September, Defra announced that grant funding agreements (GFAs) were starting to be issued to successful applicants under the Farming Equipment Technology Fund (FETF) Productivity and Slurry themes.

On 18th September, Countryside Stewardship Higher Tier (CSHT) opened for applications from invited and eligible businesses who had received pre-application advice and completed any necessary preparatory work on a controlled rollout. Since January 2025, 1,500 people have been invited to receive the pre-application advice from Natural England and the Forestry Commission. The new and improved offer of CSHT offers 132 actions and supplements, 142 capital items, with rolling applications and monthly agreement start dates and quarterly payments.

UK Agricultural Update

In July, the government published draft legislation relating to the IHT changes, part of the Finance Bill 2025-26. One keynote to take is from April 2030, the £1 million IHT allowance will begin rising with inflation, with the aim of maintaining the value of tax reliefs over time. However, the limit remains per person and cannot be transferred between spouses or civil partners.

Vivergo bioethanol plant at Humberside permanently closed at the end of August 2025, due the owners, ABF, admitting the facility will not be profitable following the announcement of the UK/US trade deal in May, removing US tariffs on US ethanol. It is set to impact UK agriculture with an average of 271,000 tonnes per year of UK wheat processed into bioethanol, creating a further drop in demand for grain, both domestic and imported, keeping prices under pressure.

On 1st August, NFU Sugar met with British Sugar again to discuss the 2026/27 beet contract. Unfortunately, no agreement was reached. By 15th August, British Sugar announced that a deal had been agreed:

- A one-year fixed price contract at £30/t, for up to 65% of the contract

- A one-year contract with a guaranteed base price of £25/t, plus a Market-linked Bonus for up to 100% of the contract

- An Index-linked contract (previously known as “Futures-linked”), for up to 50% of the contract

- Yield Protection at a £1/t reduction on the fixed and Market-linked bonus contract prices

Transport allowance up to 60 miles for all factories - One-year contract holiday option for up to 750kt, on a first-come, first-served basis at the point of contracting in My British Sugar

- Plus, an interest-free cash advance option, a late delivery payment, and complimentary frost insurance

September 2025 saw a cabinet reshuffle, Emma Reynolds, MP of Wycombe, has replaced Steve Reed, as Secretary of State for Environment, Food and Rural Affairs. Angela Eagle has replaced Daniel Zeichner as Minister of State for Food Security and Rural Affairs.

UK WEATHER

July began with high temperatures, with the hottest temperature of the year so far, 35.8°C recorded in the south. Unsettled weather was caused as frontal systems moved in, bringing rain to many areas and causing temperatures to drop to below average in most areas for a couple of days. More settled weather returned in the second week with above average temperatures and dry weather for much of the country, with Scotland and the northwest experiencing some thunderstorms. The month finished with unsettled weather with rain and isolated showers across much of the country. Overall, rainfall was below average, although there was strong regional variation. The UK monthly extremes saw a maximum temperature of 35.8°C recorded on 1st July in Kent and a minimum temperature of 1.1°C on 8th July in Sunderland.

August was a turbulent month with striking contrasts, with the UK experiencing both stormy and settled weather, with prominent heatwaves causing drought conditions. Storm Floris arrived on 4th August bringing prevailing winds and heavy rain, particularly affecting Scotland and Northern England. The East and Northeast of England experienced some of the warmest and driest conditions, with 21.5°C being the average maximum temperature; rainfall was notably low at just 21.1mm, 29% of the long-term average. Heatwaves elevated the average temperatures between 11th to 15th September, as well as the sunshine totals seen across the country.

Overall, summer 2025 is officially the warmest on record with a mean temperature of 16.10°C, surpassing the previous record of 15.76°C set in 2018.

September was a wet month compared to the rest of the summer for much of the UK, with 32% more rain than the long-term average, with Wales seeing the most drastic rainfall with 74% more rain than average, with the low-pressure systems bringing more frequent rain. The UK’s highest daily maximum temperature was 27.8°C, with the lowest overnight minimum temperature of -5°C, suggesting that the rest of autumn may be set for variable temperatures.

HARVEST 2025

Harvest 2025 has been extremely challenging for many growers. Even where yields have been above expectations from earlier in the year, price declines throughout the course of the year will have had a significant impact on the profitability of arable farms.

Overall, the 2025 harvest progressed quickly with little need to dry crops, though rainfall slowed the pace of harvest towards the end. But the overriding message from this harvest is variability, with considerable variations in yield both within and between regions.

Average wheat yield reports have ranged from 5.4t/ha – 11.2t/ha, with ranges fluctuating on farms with similar weather and soil types. Spring crop yields were reported to been reasonably good, but some did not meet specification as expected due to the dry growing conditions throughout the season.

The highlight for many for Harvest 2025 has been Oilseed Rape with average yields (3.7t/ha) topping the 10-year average (3.3t/ha).

As this year’s Sugar Beet harvest commences, NFU Sugar has reported that initial average sugars for deliveries into Bury St Edmunds and Wissington factories at the end of September were 17.98% and 17.69% with highs of 19.84% and 19.14% respectively.

CLIMATE & CARBON

UK Policy & Regulations

Carbon Budget and Growth Delivery Plan: The UK government has a legal deadline of 29th October 2025, to publish a new plan outlining its strategy for a low-carbon economy.

UK Sustainability Reporting Standards: A consultation on the draft UK Sustainability Reporting Standards closes in September 2025, with final standards based on ISSB standards expected to be published in autumn 2025.

Forestry Carbon Resources: On 22nd September 2025, Forest Research launched new carbon-focused resources on the Climate Change Hub for forestry management.

International & Corporate Developments

EU Climate Action Event: The European Commission hosted a high-level event on 30th September 2025, for stakeholders on climate action.

ING Climate Update: Financial institution ING published its Climate Update 2025 on 18th September 2025, detailing its progress and approach to climate action.

Corporate Reporting Uncertainty: The IFRS Foundation published examples on reporting climate-related uncertainties in financial statements in early September 2025.

SUPPLY CHAIN

On 24th July, the UK and India signed a trade deal, first announced on 6th May. It aims to create trading opportunities between the countries, with key points relating to lamb exports (India eliminating their 33% import tariff), whiskey and gin (tariffs on UK exports to India reduced from 150% to 75% immediately, with a further reduction to 40% over 10 years). The UK has also agreed to remove tariffs on 99% of Indian exports.

On 18th August, the UK Government announced the suspension of extra border checks on live animal imports from the EU and specific animal and plant products from Ireland / Northern Ireland. This comes ahead of a new sanitary and phytosanitary (SPS) deal with the EU (first unveiled at the UK-EU summit in May). It will establish a UK-EU SPS zone and aims to make the trading of food both cheaper and easier. This could strengthen food supply chains.

A risk-based approach is being adopted to manage biosecurity and the position will be reviewable. This suspension follows from the announcement in June that checks on medium risk fruit and vegetables from the EU would not be brought into force in July 2025 but suspended until the end of January 2027.

CONSUMER BEHAVIOUR

Quarter three saw consumers remaining financially cautious, responding to economic pressure with continuous intentional awareness of how they spend, discover and engage with brands. Overall confidence in the economy remains low, however, after two quarters of pessimism, it appears that consumers’ outlooks are becoming more optimistic, especially the millennials driving the positive shift. Value for money continues to remain the top driver, with an emphasis on brand trust and experience; with consumers wanting reassurance and support from these brands.

LIVESTOCK MARKETS

Pork

UK pig meat production has been revised to be slightly lower since May, with the revised now expected to reach 988,000 tonnes in 2025, with a year-on-year growth by pig numbers and higher carcase weights.

Exports continue to grow, driven mainly by China, however, imports have slowed as gap between EU and UK pig prices closes. Higher beef prices in retail are subsequently leading to consumers switching to pig meat.

Dairy

GB milk volumes have continued to increase throughout the summer, 2025/26 season is forecast to record a new high of 12.89 billion litres, up 3.6% from 2024/25.

Increased yields are largely due to incentives to push production. Despite grass growth problems for many during the summer, autumn rain after the drought is now producing a flush of grass growth which could take some pressure off forage stocks and allow a late silage cut.

Lamb

The market has seen bumper lamb imports so far in 2025, with volumes up 10% on the year from January to May.

This aligns with the seasonally lower domestic production at the very start of the year and improved access under Free Trade Agreements with both New Zealand and Australia.

The average lamb price (R3L) for this quarter is 725.9p/kg, a 62p/kg decrease compared to the same period last year.

Beef

A combination of constrained supply and consumer demand have driven cattle prices to historic highs. After May’s record high, farm prices have edged lower while shelf prices keep rising, trimming, but not erasing, the wide gap between them.

Prices have finished the quarter at 641.5p/kg/dw for all steers, a 135.15p/kg/dw increase compared to the same period last year, a 26% increase.

For the second half of 2025 it is expected that retail and food service beef prices to remain elevated as a result of constrained supply. This, together with wider economic uncertainty, is likely to impact shopper confidence in purchasing beef.

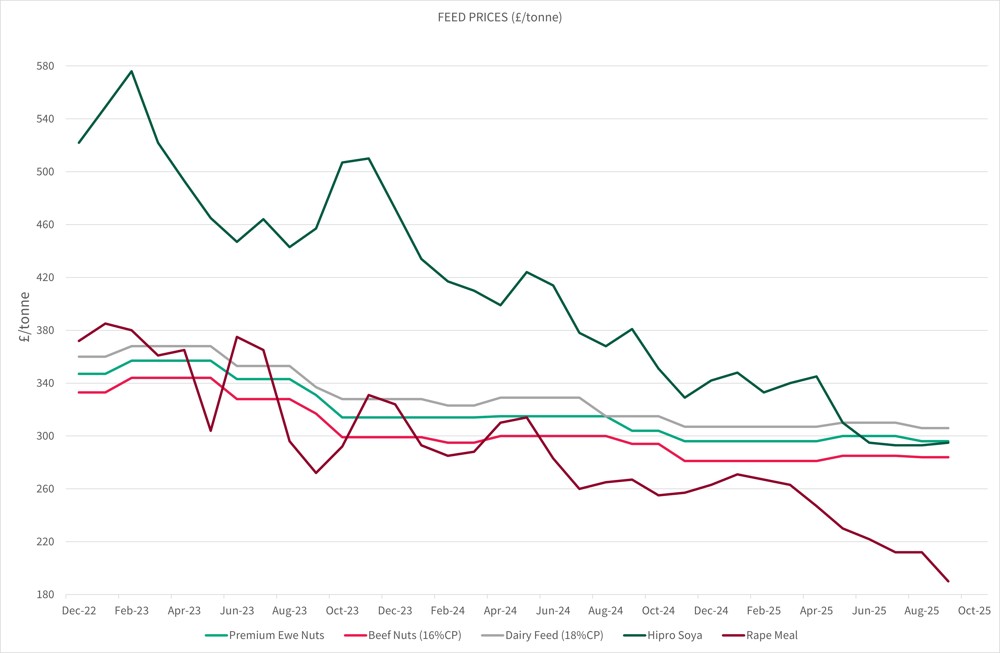

FEED

Feed Prices (£/tonne)

Dairy feed, beef nuts, hipro soya and ewe nuts all remained stable in price with no change across the quarter.

Rape meal price continued to fall, with a £40/tonne decrease. The declines are due to increased global supply, decreased demand, and potential changes in trade policies. Specifically, larger soybean harvests in South America and a potential US-China trade deal have contributed to lower prices.

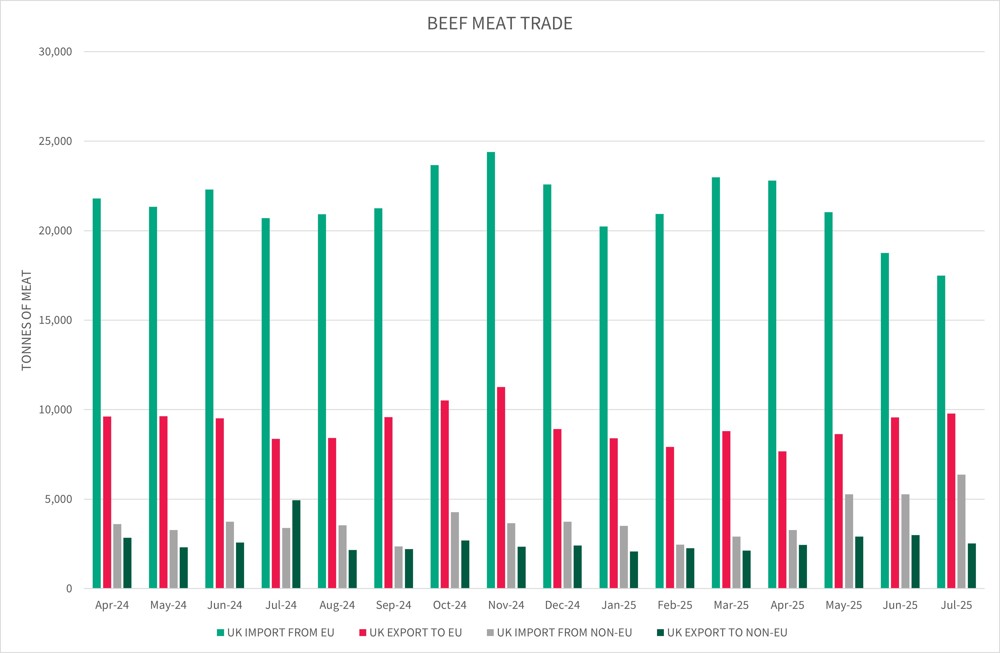

BEEF MEAT TRADE

Beef

The most significant difference between July 2024 and July 2025 is with UK imports from non-EU countries, with 3,390 tonnes imported in July 2024 and 6,371 tonnes in July 2025, almost double.

Unsurprisingly, UK export to non-EU have decreased from 4,941 tonnes in July 2024 to 2,515 tonnes in July 2025. The UK remained a net importer for beef meat in July 2025 with a net balance of 11,565 tonnes.

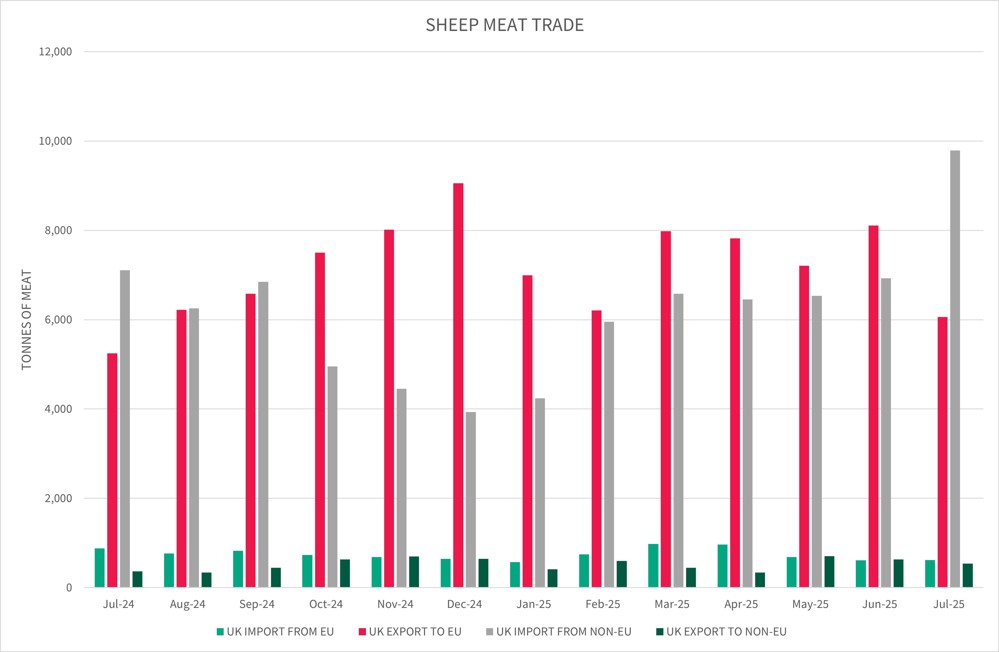

SHEEP MEAT TRADE

Sheep

Similarly to the beef meat trade, UK import from non-EU for sheep meat have increased from 7,110 tonnes in July 2024 to 9,787 tonnes in July 2025.

The UK became a net importer for sheep meat in July 2025 with a net balance of 3,802 tonnes.

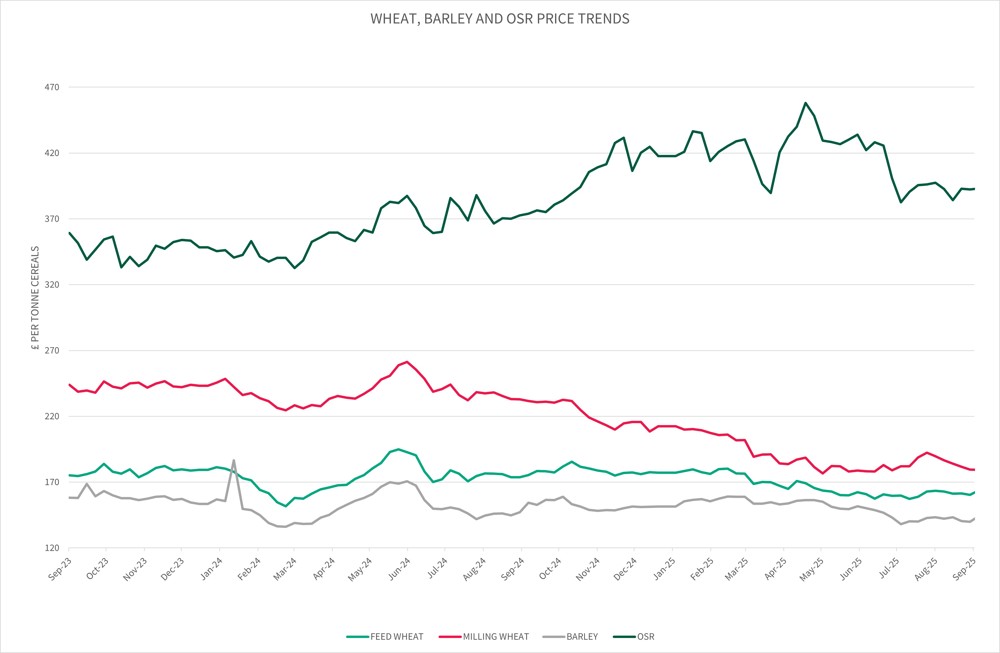

WHEAT, BARLEY AND OSR TRENDS

Feed wheat price has been relatively static, ending the quarter at £162.40/tonne, compared to £159.60/tonne at the end of the previous quarter.

Milling wheat price has seen an overall decrease in price, ending the quarter at £178.70/tonne, with a milling premium of £16.30/tonne. However, throughout the quarter milling prices have fluctuated, with the peak in the milling wheat price in mid-July of £192.30/t, with a milling premium of £29.40/tonne.

Oilseed rape has also experienced fluctuations across the quarter, closing the quarter at £399.70/tonne, a small change from the end of the previous quarter at £400.70/tonne.

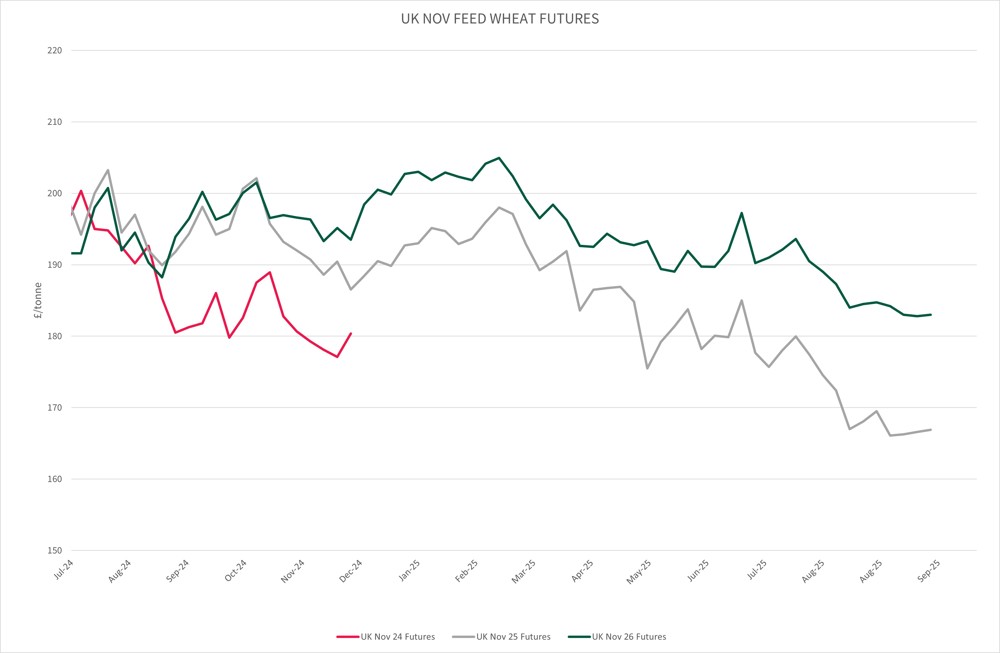

FUTURES MARKET

UK Nov Feed Wheat Futures

Both November 2025 and November 2026 wheat futures continued their trend of falling in quarter 3.

Prices closed the quarter for November 2025 at £166.90/tonne and November 2026 at £183/tonne, a difference of £16.10/tonnes.

INPUTS

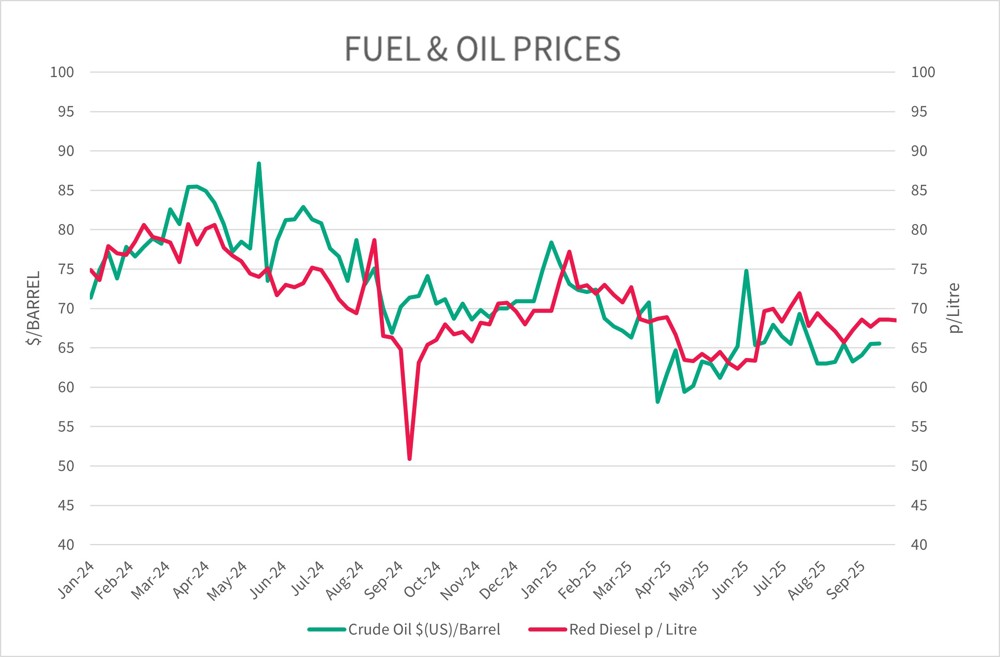

Fuel & Oil Prices

Crude Oil prices have remained relatively static, increasing by $0.15/Barrel throughout the quarter.

Red diesel saw a decrease of 1.37pence/litre across the quarter ending at 68.60pence/litre.

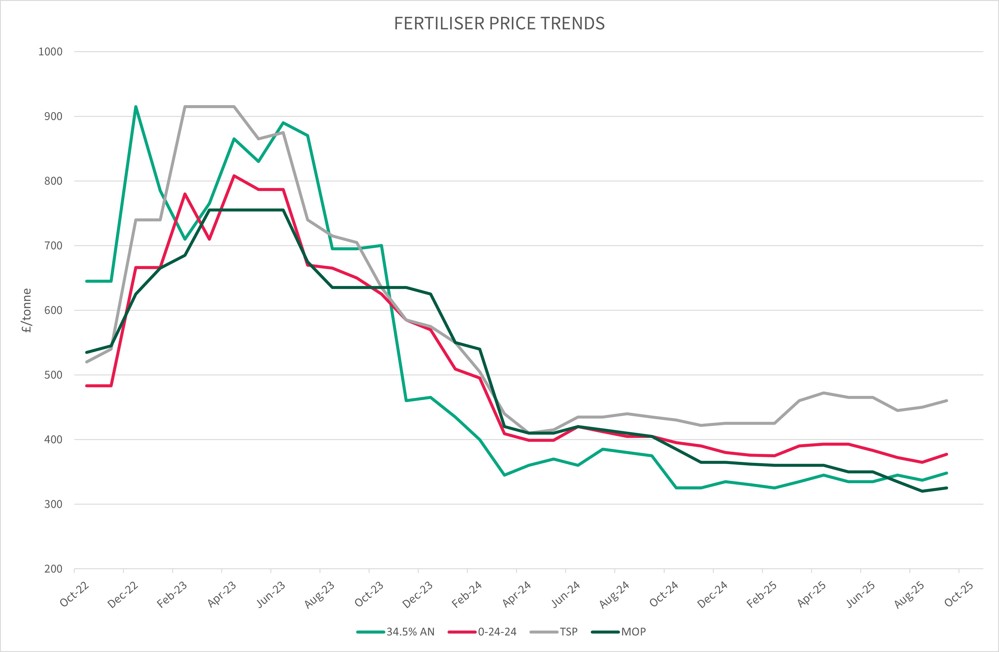

FERTILISER

Fertiliser Prices

Overall, fertiliser prices have increased over the quarter.

34.5%AN started and ended the quarter at £390/tonne. 0-24-24 has increased by £20/tonne. In the same period TSP has increased by £15/tonne to £530/tonne and MOP increased by £5/tonne, ending the quarter at £370/tonne.

Contact your local office for further details

Keep updated

Keep up-to-date with our latest news and updates. Sign up below and we'll add you to our mailing list.

Brown&Co

Brown&Co