Beefed Up: why beef prices increased and will those higher values be sustained?

Tue 27 May 2025

The growth in GB beef prices has been extraordinary. A farmer selling a 325kg steer carcase today would pocket around £700 more for that animal than at this time last year.

What may have seemed a short-lived spike in prices has instead seen sustained growth over a longer period.

The national average GB deadweight steer price hit £5/kg in September 2024, at that time hailed as a landmark. Trade was described as “flying” and sales as “buoyant”.

Whilst these were valid observations, prices were forecast to be sustained only in the short-term.

Few would have predicted that the price would have risen to £6/kg by February 2025. By mid-April, the price jumped again, this time to over £7/kg.

What has led to this unprecedented price rise and what can the UK’s beef trade realistically expect going forward?

We look at whether current prices are here to stay and how the current situation translates to profitability.

Contraction of average herd size

Historical data on breeding cow numbers and cull prices offer part of the backstory to today’s prices.

Restrictions placed on the hospitality sector during the COVID-19 pandemic gave prices little opportunity for growth aside from the spikes that occurred between lockdowns.

Cull prices in 2020 began at around 220-230p/kg, dropping to 209p/kg in April, recovering to 267p/kg in August but returning to 220p/kg by December.

What followed was a steady rise in prices through 2021 and with the average topping 300p/kg by March 2022. Other than a brief dip below this in autumn 2023, cull cows sat up around the 350p/kg mark until the end of 2024.

Cull prices should not be seen as a benchmark for prime beef but, coupled with stocking numbers, they provide a useful insight into decisions made by farmers.

The UK’s beef herd has been contracting for over a decade, a position recently accelerated with cull and heifer sales rising simultaneously. At the start of 2020, the national breeding herd sat at 1,469,967 cows, falling by 2% by December 2021, to 1,437,334.

What followed were three successive years of rising prices and this incentivised cull sales at a time when variable and overhead costs climbed and primary government financial support was removed, severely hitting profitability at a farm level.

Farmers reacted by reducing the size of their breeding herds or not replacing them.

In 2024 the number of prime cattle slaughtered rose by 4% compared to 2023; steers saw a marginal 3% increase, yet the bulk of this, 7%, came from heifers. In effect, an additional 54,000 replacement heifers went into the prime beef supply chain in 2024 instead of being retained for breeding. Consequently, the UK’s total beef breeding herd fell to 1,334,691 in 2023, 9% below numbers at January 2022, and to 1,277,162 in 2024, 13% less than in January 2022. As a reference, the UK’s dairy breeding herd fell by only 0.4% between 2019 and 2024.

Fewer beef cows means fewer calves; 2023 saw registrations fall by 2.5% and by a further 1.8% in 2024, reductions which would have been more severe had dairy-beef calf registrations not risen year-on-year. Simply put, there are fewer male and female beef animals, ranging from young calves to two year olds, than before recent price rises. Supply will therefore be squeezed – by as much as 5% in 2025 alone - and will continue to have a significant impact on prices. The consensus is that whilst the market remains volatile, the UK breeding herd will continue to shrink. A stabilisation of prices and improved profitability are most likely to incentivise a reversal. Nevertheless, if farmers simultaneously decide to retain greater numbers of heifers as replacements, more animals would be taken out of the beef supply chain and this would further tighten short-term supplies.

Import-export dynamics

Over the last decade, the UK’s beef and veal supply averaged 1.09 million tonnes a year. Of this, domestic production contributed between 80% and 87%. The UK is a net importer of beef products - an average of over 320,000 tonnes was imported and 140,000 tonnes exported each year in that decade, with fluctuations according to domestic supply and consumer demand. With UK beef production set to decrease, imports will have to fill the gap. Last year, imports grew by 8% from 284,000 tonnes to 307,000 tonnes. Ireland is by far the biggest supplier, a country with around three-quarters of the market share. Incentivised by a stark price differential and a ready supply, Ireland has pushed to access the UK’s stronger markets. The remainder is split between other EU countries (particularly Poland, the Netherlands and Germany) and other nations further afield such as Brazil, Australia and New Zealand. Whilst whole and half carcases make up around 15% of UK beef imports by weight, the majority is boneless cuts and mince to supply the market for burgers and ready meals.

On the export side, 2024 saw a 9% rise to 142,000 tonnes; whilst around 80% is exported to the EU, other notable destinations include Hong Kong, Canada, the Philippines, Ghana, Senegal and South Africa. Taking advantage of the UK’s reputation for high-welfare and sustainable production, the export market sees everything from valuable boneless cuts to whole carcases and offal sold abroad.

If UK supplies are to reduce by as much as 5% in 2025 and demand holds, there will be a balance to be struck between import and export volumes. If exports remained the same as they were in 2024, imports would have to rise by 15% to support demand, but if imports remained the same as for 2024, export quantities would be cut by a third to meet UK consumer demand. This is purely on a total weight basis, with supply agreements and consumer choices factored in. The AHDB expects a 12% import increase and 7% export decrease.

Mirroring the reduction in suckler cow numbers and eroded profits, EU beef production is also forecast to fall and could make UK exports more competitive, yet a greater dependency on imported beef could push up prices at home. With European supplies on the whole strained, this could open the door for more trade from the Southern Hemisphere.

Consumer demand persists

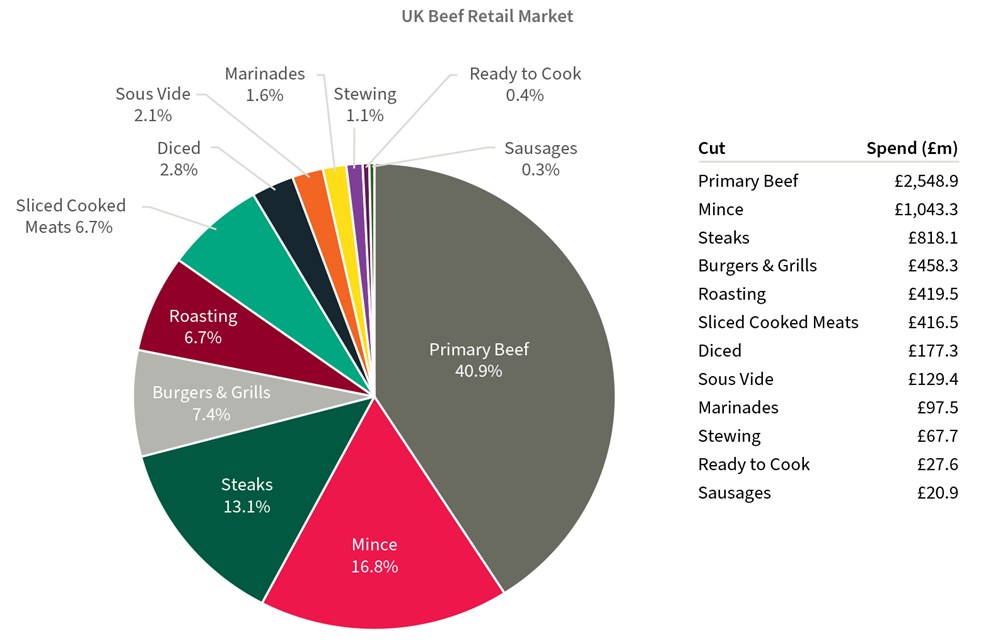

The consumer’s appetite for beef seems to be undiminished by the ongoing cost-of-living crisis. Although the price of food and everyday essentials has risen faster than incomes for many, beef is an item on the menu which the British population is reluctant to go without. Retail spend on beef was around £5.2 billion in the year at the end of March 2025, rising 4.6% year-on-year, with both price and volume up.

At a farm level, average prime cattle prices rose from 481.4 p/kg at April 2023 to March 2024 to 531.4 p/kg at April 2024 to March 2025. This represents a 10% rise in deadweight prices between years. For consumers, total beef purchases increased by only 3.8% at a household level, suggesting that the margin is being swallowed by processors, supermarkets and retailers, rather than being fully passed on to the end customer.

Whilst the total spend may have risen over the last 12 months, the type of cut purchased reveals some change in consumer behaviour. Roasting and stewing joints saw the biggest price jump of 10.6% and 6.0% respectively, yet sales volumes were down 5.7% and 5.0%. Meanwhile, mince and steaks rose in price by 2.4% and 5.8% respectively but still saw growth of 3.5% and 1.7% in the retail sector. A surprise uptick in sales came from beef sausages which saw a 20% growth in sales volume alongside static prices, indicating a switch to a cheaper alternative to pork.

Despite greater scrutiny of livestock farming’s sustainability, particularly greenhouse gas emissions, in recent years, and perceived threats to the meat industry from changing diets or cheaper imports, the demand for beef looks set to remain. Owing to its culinary versatility and heritage, not to mention quality or ready availability, British beef is expected to remain a constant on the nation’s plate.

Rising costs, falling profits

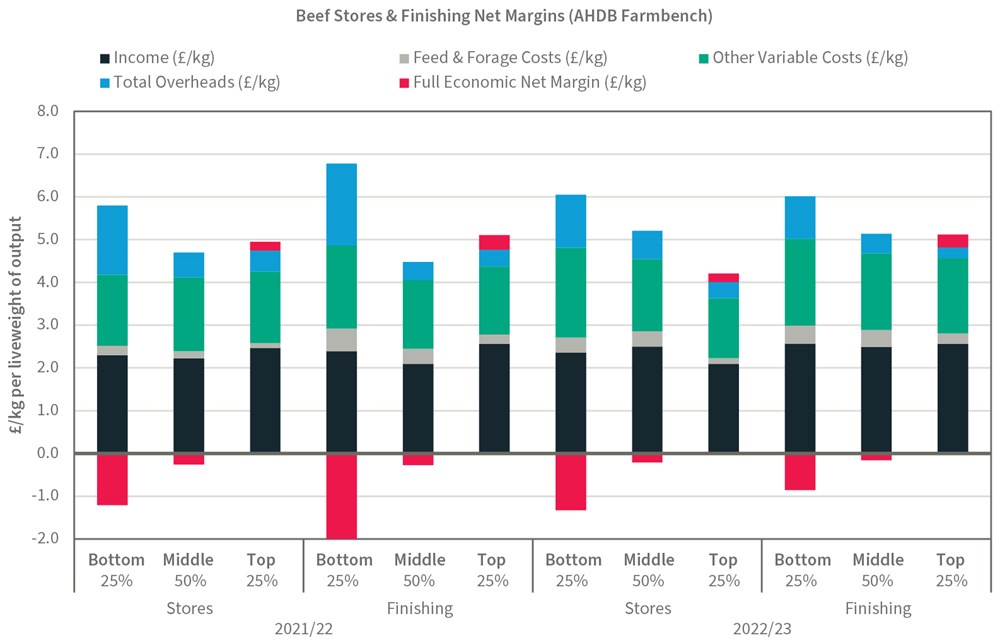

Cost of production figures in the beef sector lay bare the difficult position UK’s beef farmers are in. AHDB Farmbench data for 2021/22 and 2022/23 shows that only the top 25% of farms with beef store and finishing enterprises made a positive net margin. In other words, the average UK beef farm made a loss on stores and finished cattle during these years.

This period was marked by a considerable level of inflation, particularly in feed, forage inputs and fuel prices, leaving livestock farmers at considerable risk. Yet this has abated since its peak in 2022.

The graph above shows that the main difference between top and bottom performing farms is not price or variable costs but predominantly overheads. Whilst comparable data for 2024/25 is not yet available, a question mark remains over whether the rise in price has translated into a rise in profitability.

In simple terms, if all costs were to remain the same as for the year 2022/23, the bottom 25% and middle 50% of finishing enterprises would need to see a 33% and 6% rise in prices respectively to breakeven. To match the results of the top 25% farms, this would require a respective rise of 45% and 18% in price. In actual price terms, finished deadweight prices have risen by approximately 19% between the years 2022/23 and 2024/25 but the costs of production will have absorbed a proportion of this.

This highlights the scale of the problem for UK beef farmers. Despite such an uplift in price, margins remain stretched. Furthermore, those that make a profit margin do so not from total output alone, but by targeting cost reduction and efficiency too.

Future outlook

Instead of market supply and demand conditions returning to a more normalised position, we know that supplies will continue to be constrained in the coming months and that prices will remain supported.

Consumer demand, although difficult to predict, appears to be strong and is not expected to dissipate. With vendors eyeing a push for the approaching summer BBQ season, it remains to be seen whether rising retail prices will dull the current appetite.

With UK beef supplies squeezed, imports are predicted to rise to meet demand whilst exports may fall. UK beef is sold around the globe and exporters will be keen to retain this trade. However, with EU supplies also on a downward trajectory, more beef may be sourced from non-EU countries.

At farm level, net margins and profitability of store and finishing cattle enterprises remain vulnerable, despite the rise in output. Factoring in the higher costs for feed, forage inputs and finance, there is no guarantee that price will translate to profit.

Keeping track of costs for the enterprise and the whole farm is key to a financially sustainable business.

Keep updated

Keep up-to-date with our latest news and updates. Sign up below and we'll add you to our mailing list.

Brown&Co

Brown&Co