Quarterly Agricultural Update | April -June 2025

Thu 31 Jul 2025

Brown&Co’s market update provides an overview of commodity prices for 2025. It also provides an overview of points to consider going forward into Summer 2025, which include Environmental Schemes, Delinked payments, and New Agricultural Policies.

Download the April - June Ag Update

The Brown&Co Agricultural Update Report reviews the previous financial quarters, highlighting the changes in market prices and trade patterns of commodities during the period. This report analyses the cereals, oilseeds, milk, and meat prices, as well as input prices such as fuel, fertiliser, and feed.

The Standard Pig Price (SPP) increased slightly towards the end of the second quarter of 2025, finishing at 207 pence per kilo deadweight (p/kg/dw).

Defra farmgate milk prices have increased significantly since June 2024 and averaged 43.12 pence per litre (ppl) in June 2025, an increase of 4.72ppl year on year.

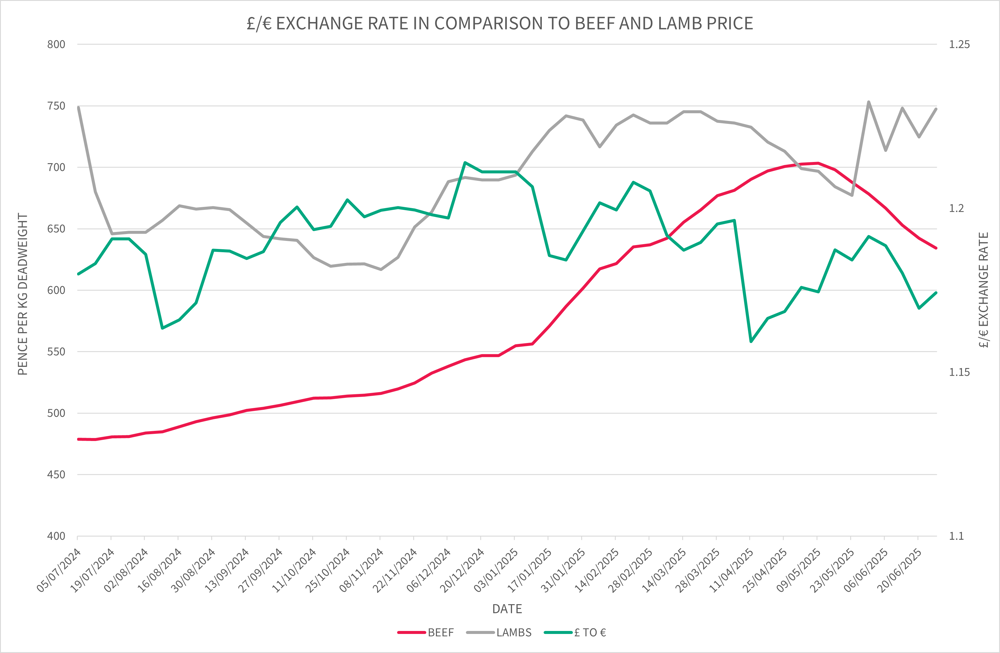

Lamb prices experienced another price increase at the end of quarter two of 2025 hitting a peak of 747.4 p/kg/dw (R3L) at the end of June 2025, despite lows of 677.1p/kg/dw in mid-May.

Beef prices for All Steers have seen a weekly increase since July 2024, seeing their peak in early June at 703.4p/kg/dw. However, there have been weekly declines since, ending the quarter at 634.3p/kg/dw.

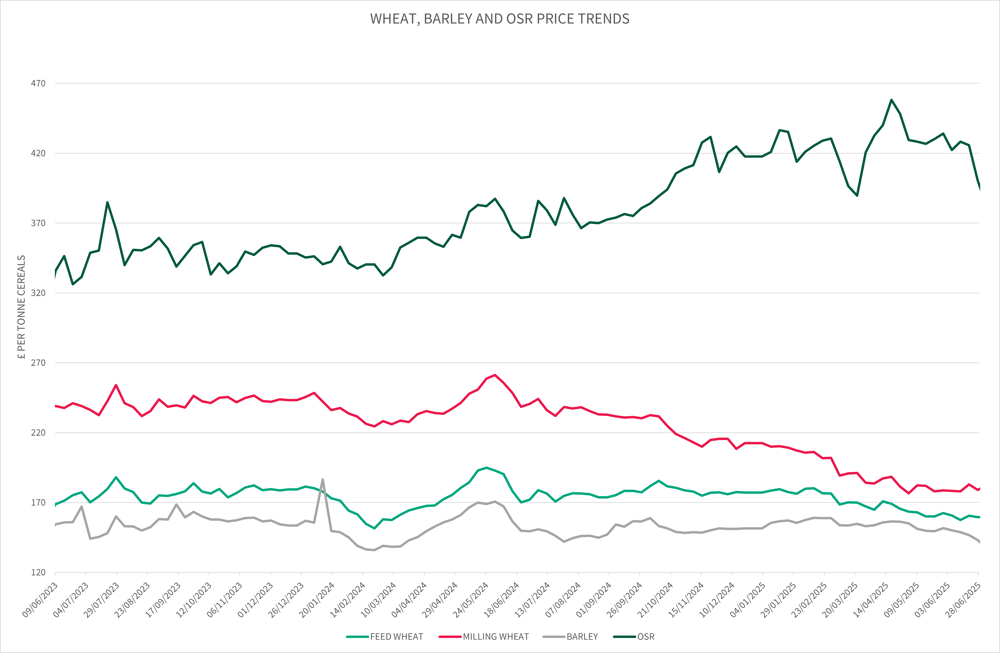

Cereal & Oilseed prices have continued to be under pressure throughout the second quarter of 2025, hitting a low of £157.50/t in mid-June for feed wheat. Despite a £37.50/t rally at the start of quarter two for OSR, it remained under pressure throughout the rest of quarter finishing at £400.7/t, a £31.8/t reduction from the start of the quarter.

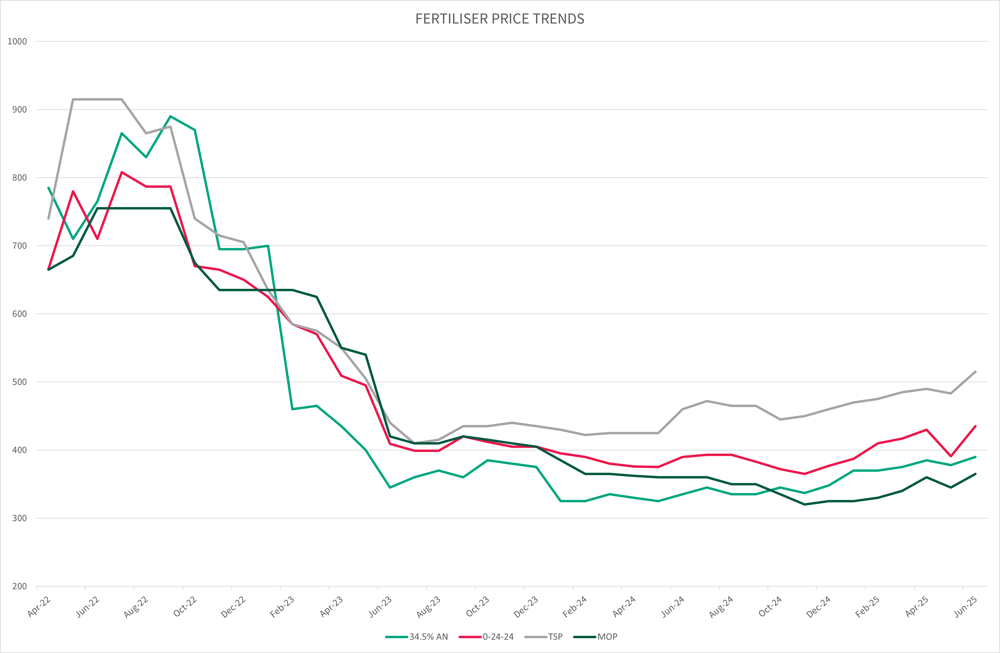

Fertiliser prices have experienced a gradual, but consistent increase in price throughout the second quarter of 2025, ending at £390/t for 34.5% AN.

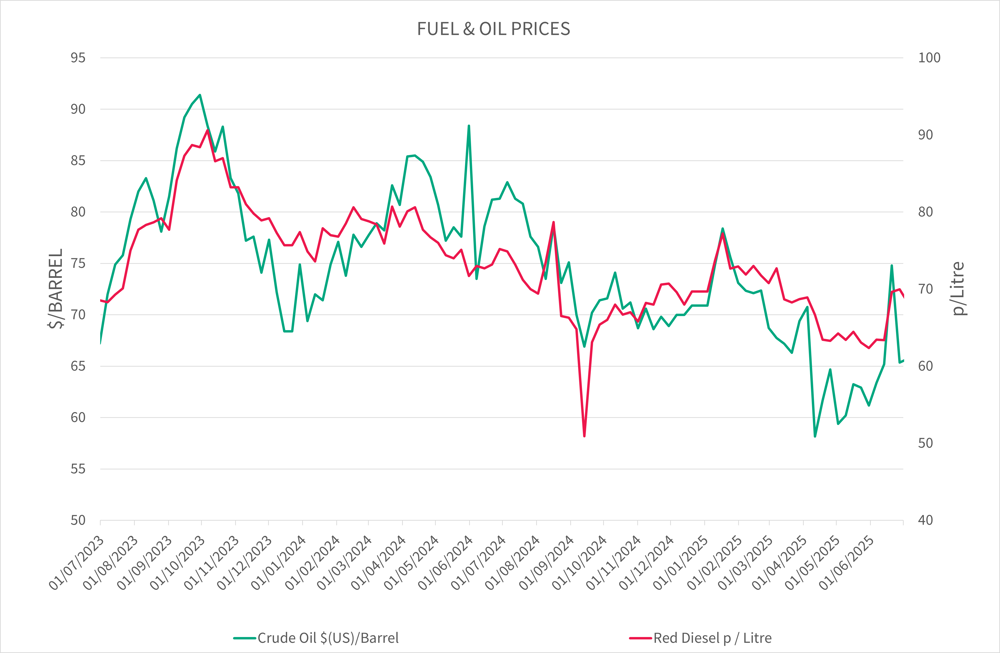

Crude Oil prices have decreased by $4.05/Barrel. Quarter two saw a high of $74.79/Barrel and a low of $58.16/Barrel. Red diesel saw an increase of 1.27pence/litre across the quarter ending at 69.97pence/litre.

Environmental Schemes

The Countryside Stewardship 2025 claim window closed on 15th May 2025. Claims can still be submitted until 1st September 2025, subject to reductions. Rotational option declarations need to be submitted by 1st September 2025.

Countryside Stewardship Capital Grants are expected to reopen in July 2025.

SFI 24 to reopen for selected applicants who had started but not yet submitted an application within two months of its closure on 11th March 2025. Applications will be capped at £9,300.

Applications are planned to be reopened on 7th July 2025, with eligible applicants contacted via email by the RPA.

Defra announced HLS payments will be increased by 34.4%; the new payment rates apply from 1st January 2025 and agreement holders will receive the updated payment with their 2025 claim, which will be paid in December 2025. The boost in payments will total £30 million.

Delinked Payment Scheme

Following the Spending Review announcements on 11th June 2025, Defra confirmed delinked payment cuts in 2026 and 2027.

A 98% deduction will be applied to the first £30,000 of any delinked payment - the maximum receivable amount now being £600 as any amount above £30,000 will be reduced by 100%.

New Agricultural Policy

The Spending Review announcements on 11th June 2025 confirmed an updated funding package that will allocate over £2.7 billion per year into sustainable farming and environmental recovery from 2026/27 through 2028/29 in England. Key highlights include a 150% increase in funding for Environmental Land Management (ELM) schemes—from £800 million in 2023/24 to £2 billion by 2028/29. However, the spending forecast does show a decrease in funding in other grants such as productivity, innovation and transition payments from £350 million in 2026-27 down to £250 million in 2028-29.

Farm Profitability Review – Baroness Minette Batters has been appointed to head Defra’s review into farm profitability. The review will be fed into the 25-Year Framework and the National Food Strategy.

Defra announced the Farm Equipment Technology Fund (FETF) will be opening for applications from 29th May 2025 for just 6 weeks; closing on 10th July 2025. The funding covers all three themes: Productivity, Slurry Management and Animal Health & Welfare. Total Defra funding is £46.7 million; minimum grant funding per application is £1,000 up to a maximum of £25,000 per theme.

Bluetongue – The Bluetongue Virus restricted zone will be extended from 1st July 2025 to cover the whole of England. Due to the large area of spread, movement restrictions are no longer an efficient way of controlling the disease. This effectively means the end of movement restrictions for animals and allows farmers to move livestock throughout England without movement tests.

UK Weather

April started similar to March, with high pressure bringing settled, dry conditions across the UK. Initially, temperatures were above average but dipped slightly below normal mid-month due to easterly winds. Low pressure brought unsettled conditions with heavy rain between the 14th and 22nd of the month. April ended with a return to high pressure, warmer and settled conditions. The UK’s mean temperature was 9.6°C with maximum temperatures reaching 26.7°C. April was the sunniest on record for the UK.

May overall was warm, sunny and dry, with high pressure dominating for most of the month. Heavy rain and thunderstorms were received by the southwest due to low pressure before the high pressure returned once again. Clearer skies at night, led to some cooler nights, with some frosts in northern and rural areas. The second week saw temperatures slightly below average, before temperatures increased going into the third week. The weather was mostly fine, before low pressure brought scattered showers throughout the UK until the end of May, however, there were still areas that continued to see no wet weather. Maximum temperatures were widely 2°C above average.

June started with cool and unsettled weather due to persistent low pressure. Atlantic weather systems brought rain in the first week, often heavy. High pressure returned in the second week, bringing more settled weather and higher temperatures. This continued through to the middle of the month, causing extensive isolated thunderstorms and unsettledness. By the end of the month, temperatures rose again causing another heatwave. The UK saw its second warmest June, as temperatures of 30°C was reached on several occasions throughout. However, in terms of rainfall, there was a strong regional divide, with Wales, Scotland and Northern Ireland seeing well above average rainfall but England, seeing well below average, especially southern England.

Harvest 2025 Outlook

Due to the long dry spells in the spring for much of the UK and the prolonged high temperatures, harvest is off to the fastest start since at least 2006, with many reports of winter barley being harvested in June. Due to the high temperatures forecasted in July, growers are warned to be mindful of temperature claims when going into stores. After winter barley, there will now be a gap for many before winter wheat harvest commences, while some will move straight into harvesting oilseed rape. Due to the dry spring, yields are expected to be lower than average and there is some concern that nitrogen contents in malting barleys will be negatively affected. Along with the stagnant low crop prices at present; it is set to be a test on cashflow in the coming year.

Climate & Carbon

Record breaking and extreme weather is becoming more common in the UK as our climate has changed over the past few decades. The last three years have been in the UK’s top five warmest on record, with 2024 being the fourth warmest year in records dating back to 1884. Reports show that the UK has warmed at a rate of approximately 0.25°C per decade since the 1980’s.

Renewable generation capacity increased by 6% compared to the same period last year, slightly below average growth rate of the last 3 years. The Department for Energy Security and Net Zero (DESNZ) Public Attitudes Tracker: Renewable energy, Spring 2025, UK: showed that overall support for the use of renewable energy has decreased from 87% in Autumn 2021 to 80% in Spring 2025.

Brown&Co Launches Carbon & GHG Services to Support Farm Business Strategy

Brown&Co has launched a new Carbon and Greenhouse Gas (GHG) service to help farmers and agri-businesses better understand their emissions and the role they play in wider business performance.

The service builds on Brown&Co’s expertise in farm business advice. Rather than treating emissions as a standalone issue, the approach integrates them into the core of farm business planning—linking reductions to operational efficiency, grant opportunities, and long-term financial resilience.

Support includes identifying on-farm emission sources, developing reduction strategies, and preparing businesses for emerging carbon market opportunities. Farms with verified carbon footprints are already seeing benefits such as improved access to finance, product premiums, improved market access and stronger positioning in tenancy and contract farming tenders.

As environmental regulation and supply chain expectations continue to evolve, this service offers a practical route to staying ahead while unlocking value.

Supply Chain

May 2025 was the month for UK Trade Deals:

On 6th May, the UK and India announced a Free Trade Agreement which was hailed the most substantial trade deal for the UK since leaving the EU. With key points relating to lamb exports (India eliminating their 33% import tariff), whiskey and gin (tariffs on UK exports to India reduced from 150% to 75% immediately, with a further reduction to 40% over 10 years). The UK has also agreed to remove tariffs on 99% of Indian exports, including agri-food products such as frozen prawns.

On 8th May, the UK and the US announced a Trade Deal, which is set to lessen the effects of the US tariffs imposed in early April. This includes a Beef Market Access, establishing a reciprocal tariff-free quota of 13,000 tonnes of hormone-free beef. Additionally, the UK has agreed to remove tariffs on 1.4 billion litres of US ethanol. In terms of Food Safety Standards, the UK maintains its ban on imports of hormone treated beef and chlorinated chicken.

The UK and EU signed a Summit Agreement on 19th May, with measures to reduce friction on agri-food trade. A key part of this agreement is the establishment of a UK-EU SPS (Sanitary and Phytosanitary) Zone, facilitating the movement of animals, animal products and plants between Great Britain and the EU. It is hoped that the reduction in SPS-related barriers should revitalise UK agri-food exports to the EU, which is estimated to have declined by 21% since 2018, largely due to increased costs and administrative burdens. Importantly, signing the trade deal, the UK has aligned with the EU and there is now a real potential UK fertiliser imports will be hit with CBAM tax from 1st January 2026.

Consumer Behaviour

Despite real wage growth in quarter two, consumer spending remains suppressed due to the economic uncertainty. Although inflation continues to fall from its peak in 2022, consumers are continuing to compare prices to pre-pandemic points, with a focus on essential spending. Spending on essential items has risen to its highest level, attributed to the impact of inflation on prices. Inflation remains above the 2% target and it is likely to go higher in the short-term due to price rises which were introduced at the start of April. The Bank of England cut the UK base rate by 0.25% on 8th May 2025, from 4.5% to 4.25%; these cuts are due to concerns around a slowing economy. The long-term outlook largely depends on economic stability, but consumer demand is expected to remain subdued in the short term.

Livestock Markets

Pork

GB pig prices saw some weakening at the very start of the year, continuing the trend seen in the latter part of 2024. Prices have since bounced back alongside positive demand, with the EU spec SPP peaking at 207.2p/kg for the week ending 20th June. It is anticipated that the production trends seen in quarter one will follow for the rest of the year with strong growth. For the full year, it is forecasted that pig meat production will increase by 3.3%, year-on-year, to around 990,000 tonnes.

Dairy

The season’s spring flush, supported by sunny weather and dairy economics, reached a peak of 39.01 million litres on 4th May 2025, the highest volume on record. In terms of exports, there has been a decline, largely driven by a reduction in exports of milk and cream which fell by 24,300t (10.9%). Cow’s milk volumes continued to decrease in quarter two, seeing a 2.6% year-on-year decline, driven by a decrease in frequency of purchase. Semi-skimmed cow’s milk, which represents 58.3% of all cow’s milk volumes, saw a decline of 4% in volume purchased.

Beef

Beef markets have experienced a dynamic first half of 2025.

A combination of constrained supply and consumer demand have driven cattle prices to historic highs. More widely, global beef markets have held firm.

Total beef production for 2025 is forecast at 897,000 tonnes, 4% lower than 2024.

Prices continued to rise in the first half of the quarter, peaking at over 700p/kg/dw at 703.4p/kg/dw in the second week of May.

Prices have come back in the second half of the quarter and ended on 634.3p/kg/dw for all steers – a 156p/kg/dw difference to the same period last year.

Lamb

The lamb crop for 2025/2026 season is estimated to be 15.6 million head, down 1% on the previous season, due to a reduction in the breeding flock.

The average lamb price (R3L) for this quarter is 718.9/kg, a 119p/kg decrease compared to the same period last year.

Feed

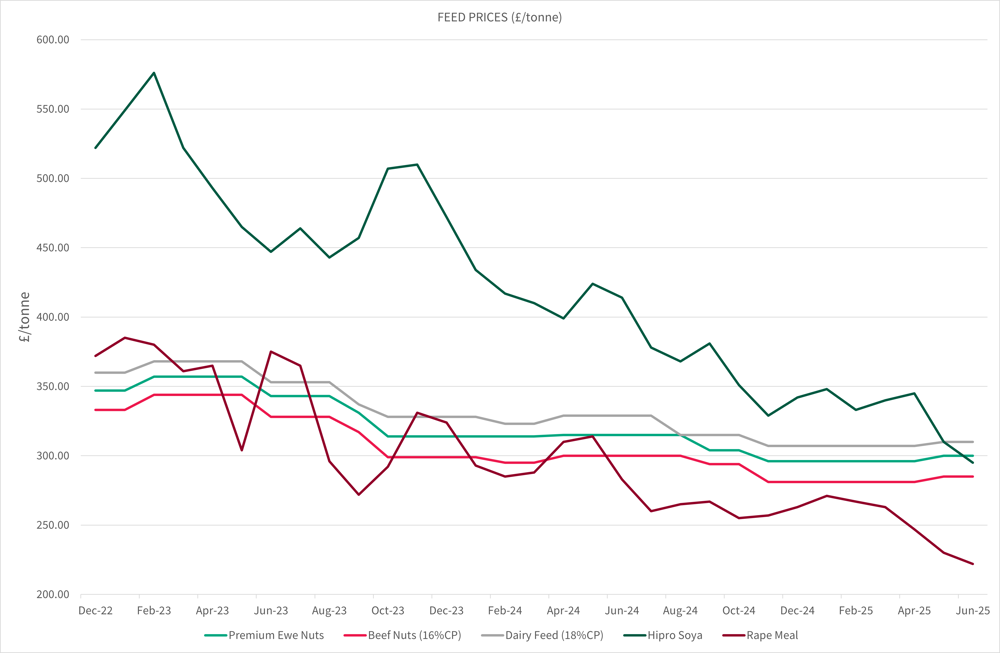

Dairy feed, beef nuts and ewe nuts all remained stable in price with no change across the quarter.

Hipro soya saw a decrease of £45/t over the quarter, while rape meal saw a £41/t decrease. The declines are due to increased global supply, decreased demand, and potential changes in trade policies. Specifically, larger soybean harvests in South America and a potential US-China trade deal have contributed to lower prices.

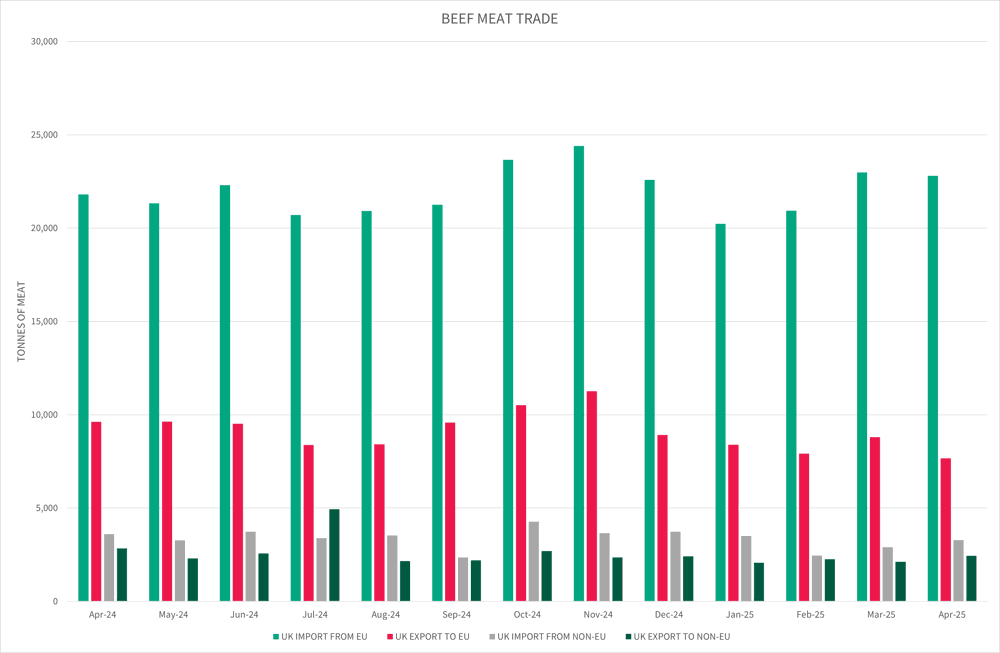

Beef Meat Trade

UK exports to the EU for beef meat decreased in April 2025 compared to April 2024 by 1,961 tonnes.

The UK saw imports from the EU increase in April 2025 compared to April 2024, by 994 tonnes.

The UK remained a net importer for beef meat in April 2025 with a net balance of 15,986 tonnes.

Sheep Meat Trade

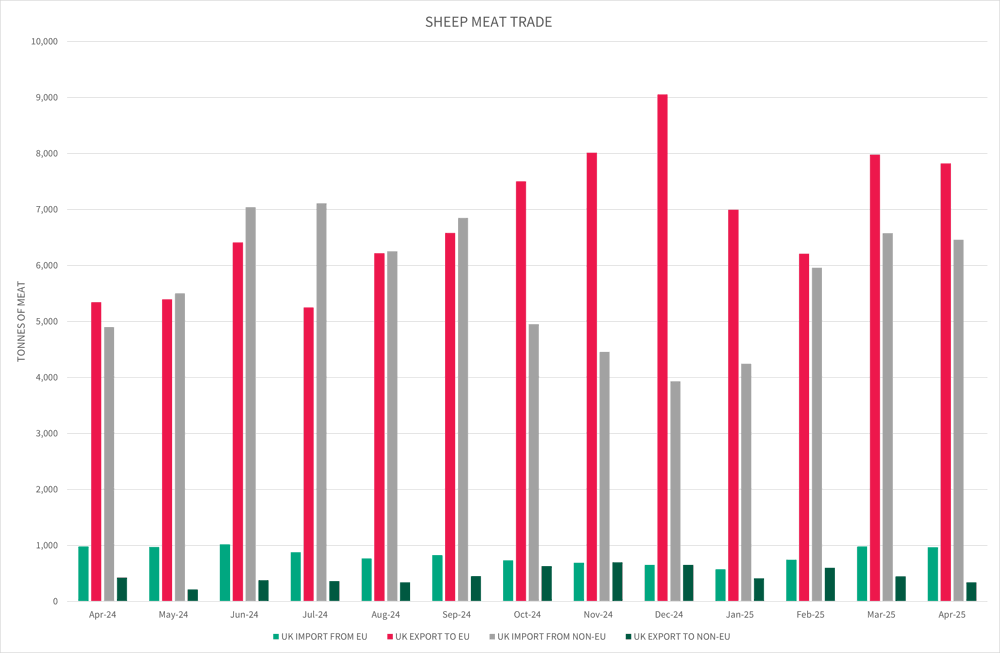

UK imports from EU for lamb trade and UK export from non-EU remained small and comparable from 2024.

However, the UK export to EU increased by 2,478 tonnes from April 2024 to April 2025.

In the same monthly time period, UK import from non-EU has increased by 1,556 tonnes.

Overall, the UK has remained a net exporter for sheep meat, with the April 2025 trade balance at 741 tonnes.

Wheat, Barley and OSR Trends

Feed wheat has seen an overall decrease in price, ending the quarter at £159.60/tonne, compared to £172/tonne at the end of the same quarter in 2024.

The decrease is due to increased global supply, stronger pound against the Euro and lower domestic demand. Barley prices have also followed the same theme.

Milling wheat price has seen a decrease in price, ending the quarter at £182/tonne, with a milling premium of £22.2/tonne.

Oilseed rape has experienced fluctuations across the quarter, with a high of £458.10/tonne in mid-April and ending the quarter at the lowest price of £400.70/tonne at the end of June. Despite other markets falling, the oilseed rape price is up 12.8% to the end of June 2025 compared to the same period in 2024.

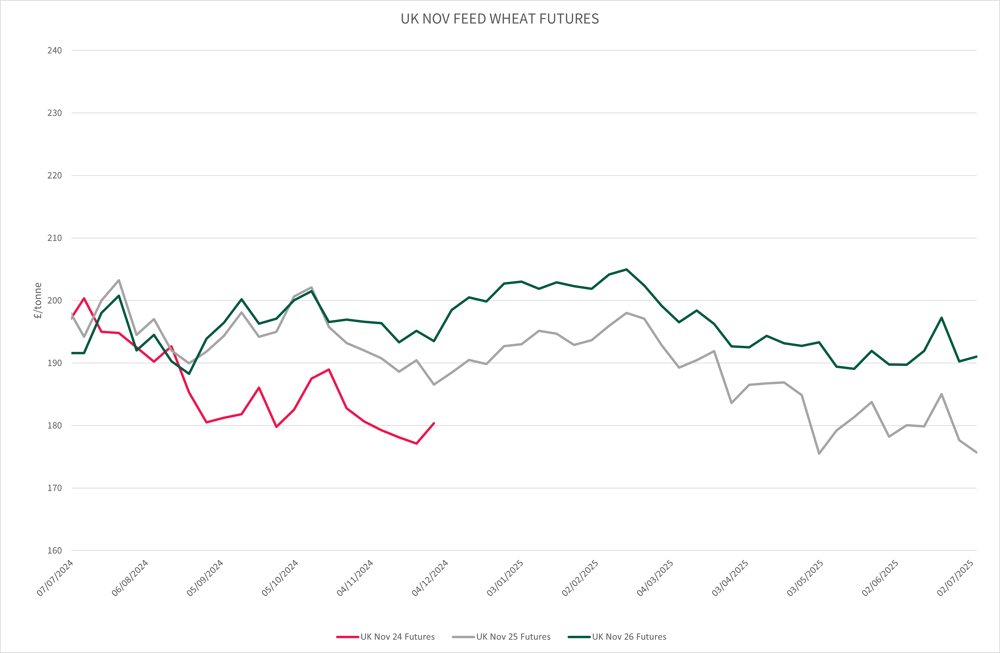

Futures Market

UK November Feed Wheat Futures

The November 2025 wheat futures spiked in mid-April, £186.90/t and the November 2026 futures peaked at £197.25/t in mid-June.

The November 2026 wheat futures were on average £10.30/t higher than November 2025 for the second quarter of 2025.

Inputs

Fuel & Oil Prices

Crude Oil prices have decreased by $4.05/Barrel across the quarter.

Quarter 2 saw a high $74.79/Barrel and a low of $58.16/Barrel with much fluctuation. There was a $12.59/Barrel decrease at the start of April and $9.59/Barrel spike in the penultimate week of June to $74.79/Barrel, but the price did fall back to round off the quarter at $65.35/Barrel.

Red diesel saw an increase of 1.27pence/litre across the quarter ending at 69.97pence/litre.

Fertiliser

Overall, fertiliser prices have increased across the quarter.

Prices dipped in May while pre-buying demand was low, but then increased again in June, with the largest increase in 0-24-24 from £391/t to £435/t, a £44/t increase. In the same period, TSP increased by £32/t from £483/t to £515/t. The June price increase was largely the cost of urea, driven by heightened demand and ongoing supply constraints.

Keep updated

Keep up-to-date with our latest news and updates. Sign up below and we'll add you to our mailing list.

Brown&Co

Brown&Co