Agricultural Update October – December 2025

Mon 12 Jan 2026

Brown&Co’s market update provides an overview of commodity prices for 2025.

It also provides an overview of points to consider going forward into Winter 2025, which include Environmental Schemes and UK Agricultural Policy updates.

SUMMARY

The Brown&Co Agricultural Update Report reviews the previous financial quarters, highlighting the changes in market prices and trade patterns of commodities during the period.

This report analyses the cereals, oilseeds, milk, and meat prices, as well as input prices such as fuel, fertiliser, and feed.

The Standard Pig Price (SPP) has decreased in quarter 4, finishing at 198 pence per kilo deadweight (p/kg/dw) compared to 206.7 p/kg/dw at the end of the previous quarter.

Defra farmgate milk prices have slightly increased this quarter ending the quarter on 46.56 pence per litre (ppl), an increase of 0.02ppl since the close of the previous quarter.

Lamb prices experienced an increased price in quarter four, hitting a high of 713.1p/kg/dw (R3L) in mid-December 2025, an overall increase of 28.6p/kg/dw from the end of the last quarter.

All Steers have seen a steady increase throughout this quarter, with an overall increase in price of 11.7p/kg/dw, ending the quarter at 653.20p/kg/dw, compared to opening the quarter at 641.50p/kg/dw.

Cereal & Oilseed markets have shown small price fluctuations, the feed wheat price has been relatively static, ending the quarter at £164.60/tonne, compared to £162.40/tonne at the end of the previous quarter. Milling wheat price has seen an overall increase in price, ending the quarter at £182/tonne, with a milling premium of £17.40/tonne. Oilseed rape has also seen an overall increase across the quarter, closing the quarter at £406.90/tonne, up £8/tonne from the end of the previous quarter at £399.70/tonne.

Overall, fertiliser prices have largely decreased with the exception of 34.5%AN which started the quarter on £390/t and ended the quarter at £405/tonne. 0-24-24 has decreased over the quarter by £42/tonne. In the same period TSP has also decreased by £32/tonne to £498/tonne and MOP decreased by £21/tonne, ending the quarter at £349/tonne.

Crude Oil prices have seen a decrease in the last quarter, decreasing by $9.09/Barrel throughout the quarter. Red diesel also saw a decrease of 1.94pence/litre across the quarter ending at 66.56pence/litre.

UK AGRICULTURAL UPDATE

Jim Mosely, CEO of Red Tractor, has announced he will step down from the role in the next six months, ending a nine year stint.

Oliver Munn has been appointed the CEO of the Rural Payments Agency (RPA) from January 2026, following external recruitment. His extensive experience spans over helping organisations deploy technology responsibility to reduce administrative burden and better service their customers.

On 9 October 2025, the first confirmed case of Bird Flu of the 2025/2026 season was in Northern Ireland, followed by England on 11 October 2025, resulting in more outbreaks since with the strain HPAI H5N1. In response to the escalating numbers of confirmed cases, a mandatory national housing order was declared in England, requiring all bird keepers to house their poultry and captive birds indoors.

As of 28 October, there had been 125 cased of Bluetongue in England, with many being detected by routine surveillance or movement testing. Vaccinations have been emphasised as the most effective long-term control measure. The Bluetongue Restricted Zone remains in place across the whole of England with movement restrictions in place for livestock crossing into Wales and Scotland.

The Farm Profitability Review, commissioned by the UK government and led by Baroness Minette Batters was published on 19 December. Minette details 57 recommendations in her 155 page report – with the core focus of the recommendations to restore the balance between food production and the environment. Baroness Batters notes there is “no silver bullet” to restore profitability.

The Autumn Budget 2025

The Autumn Budget 2025 was announced on 26 November, the Chancellor, Rachel Reeves’, second Budget. The following are key points effecting the agricultural sector:

- Minimum wage will be raised again in April 2026 from £10 to £10.85 per hour for 18- to 20-year-olds, and the National Living Wage for 21 years and above will increase by 4.1% from £12.21 to £12.71 per hour.

- A 2% increase on Income Tax on earnings from property, savings and dividends.

- National Insurance and Income Tax thresholds to be frozen for an extra 3 years beyond 2028. The fiscal drag will bring more people into higher tax brackets.

- Inheritance tax thresholds will remain unchanged for a further year until April 2031.

- The allowance for the 100% rate of Agricultural Property Relief (APR) and Business Property Relief (BPR) will be transferable between spouses and civil partners, £1 million at the date of the budget.

- There will be a mileage-based charge on electric and hybrid cars of 3p and 1.5p per mile retrospectively from 2028-2029.

- The revised Carbon Border Adjustment Mechanism (CBAM) calculation suggests that nitrogen fertiliser prices will rise less than expected when the mechanism is introduced in 2027.

- Electricity prices will be raised by an estimated 0.35ppkwh due to the reclassification on Sizewell B being funded through electricity bills.

- Business Rates will be revalued for properties from 1 April 2026, with two permanently lower business rates multipliers will be introduced for eligible Retail, Hospitability and Leisure properties with rateable values below £500,000.

Changes to APR & BPR

The government announced on 23 December that the threshold for Agricultural Property Relief and Business Property Relief will be increased from £1 million to £2.5 million when it is introduced in April 2026. As announced in the Autumn Budget, this allowance is transferable between spouses or civil partners, now allowing for £5 million of qualifying assets between them before paying inheritance tax, on top of existing allowances. Qualifying assets above this level will be subject to 50% relief.

Environmental Schemes

On 15 October, Defra announced one-year extensions to Countryside Stewardship Mid-Tier agreements which were set to expire at the end of 2025. This will ensure that over 5,000 farmers will be able to continue in their efforts to deliver environmental benefits while the new Sustainable Farming Incentive for 2026 is being developed.

FEFT 2025: Defra announced that over 8,000 applicants had been offered Grant Funding Agreements.

Water Restoration Fund (WRF): Defra has released information on the projects that were successful under WRF. In 2024, the WRF was created using environmental fines and penalties issued to water companies between April 2022 and October 2023 as part of an initiative to hold water companies accountable. A total of 51 projects will receive a share of £11m in funding. The Government has also announced a further £100m has been levied in fines and penalties against water companies since October 2023 which will be reinvested to improve water quality and pollution.

Defra announced a new National Forest to be planted in the Oxford-Cambridge corridor, to add to the already announced ‘The Western Forest’ to be located from the Cotswolds to the Mendips. A third forest will be announced in early 2026, to be located in the Midlands or the North of England.

UK WEATHER

October

The autumnal variability continued through October, with the mild temperatures persisting, pushing up long term averages. The highest maximum temperature average was 15°C seen in the central south of England, and with minimum average temperatures being 1°C above average. Sunshine hours varied considerably across the UK, the Eastern counties faired more sunshine, with East Anglia recording 76.9 hours (69% of average) and the southeast and central south 82 hours. It was reported that it was the dullest October in almost 60 years for the UK. There was a large contrast between regions, with the south and the east seeing drier and sunnier conditions, while the north and west contended with frequent rain and cloud cover. The wet conditions in the west and north have led to heightened river levels and localised flooding.

November

November began particularly mild, with above average temperatures, especially overnight. Bonfire Night was the warmest on record, with a 14.8°C recorded in Devon. Bands of rain across the country soon followed, occasionally heavy. Mid November saw exceptionally heavy rain across central and southern England as well as parts of Northern Ireland as Storm Claudia swept through. Temperatures dropped following Storm Claudia and there were some hard frosts towards the end of November. Temperatures recovered during the last few days of November, with the month closing as mild and wet. Overall, November has been characterised by some very variable weather and large temperature swings.

December

For the first part of the month, temperatures were above average, but high pressure around Christmas brought in cooler and sunnier weather. Unsettled conditions persisted for the first few weeks of December, and by the middle of the month, the UK saw 75% of its average rainfall for the month, with parts of Cornwall recording over 100%. The second half of the month was much drier, although still wetter than on average. Sunshine was on above average at 108% for the UK, with Wales particularly favoured with 126% of average sunshine.

Year Overview

Provisional Met Office figures show that 2025 has broken climate records for being the sunniest and warmest year on record for the UK. The mean temperature of 10.09°C, joins 2022 and 2023 in the top three warmest years on record, showing the increasing average temperature trend as a direct result of climate change. 2025 also goes down as the sunniest on record, with 61.4 hours more than the previous record in 2003 of 1648.5 hours. The change in climate is notable with the rainfall trend, of drought periods during the year, but still accumulating 90% of the average annual rainfall, with the shortfall accumulated over smaller time periods.

CLIMATE & CARBON

The last quarter of 2025 saw key updates in UK and EU carbon regulation, mostly outlined in the Carbon Border Adjustment Mechanism (CBAM), with the UK announcing it will introduce a UK CBAM from January 1, 2027. At the start of quarter 4, it marked a year since the UK had been powered without coal-fired power stations, however, record low nuclear generation led to an increase in gas generation to compensate. On a world level, the Global Carbon Project Projections showed that global fossil fuel emissions have increased by around 1% in 2024, while emissions from land-use change decreased.

SUPPLY CHAIN

The last quarter of 2025 has been faced with the continuation of market volatility continuing to challenge supply chain management. Cost pressures such as energy and labour costs have risen, now outweighing the pressure from material prices which have largely stabilised. Uncertainty around tariffs, with potentially more to be introduced by the US, continue to inflate cost, forcing businesses to either absorb or pass on to customers. Over the past quarter, the UK has seen slowing construction with property sector facing supply issues and low planning approvals.

CONSUMER BEHAVIOUR

KPMG analysis shows that the quarter saw 58% of consumers feel the UK economy is getting worse, which has increased from 43% at the beginning of 2025, with half agreeing that they are cutting discretionary spend as a result. 42% of consumers do not plan on spending on a big-ticket item in Q1 2026 due to thoughts of the economy worsening in the coming months or deferring purchases later into the year. However, entering 2026, the majority of people (56%) feel secure in their personal finances, falling only 1% from the beginning of 2025. Interestingly, the 3 most common reasons for consumers’ feeling the economy is worsening is cost of groceries (81%), utilities (75%) and eating and drinking out (53%). The results showed that there is a discrepancy between age groups with how they feel the economy is moving, with consumers aged 65 and over most likely to say that the economy is getting worse (70%), while those aged between 35 to 44 are more likely (24%) to say it is improving. Overall, 47% plan on spending the same amount in 2026 as they did in 2025, whereas 27% plan on spending less.

LIVESTOCK MARKETS

Pork

UK pig meat products saw a 3% increase in spend, the drive split between an increase in volumes purchased along with the increase in average price paid.

Processed meats, such as sausages, have seen an increase of 2.9% due to a rise in the frequency purchased, whereas gammon purchases increase of 8.4% is largely due to a growth in the number of shoppers for the Christmas period.

Dairy

GB milk deliveries in November 2025 totalled an estimated 1,071 million litres, up 5.2% compared to the same period in 2024.

Milk supplies have been running ahead of the five-year average since Autumn 2024, with milk supplies up 5.9%, equivalent to 453 million litres compared to last year. GB Organic Milk deliveries have been showing a continuous growth since March 2025 with a 11.6% increase year-on-year, with demand continuing to increase.

Lamb

Lamb has experienced a 7% decrease in volumes purchased over the quarter, driven by declines in the majority of cuts.

The exception to the trend is steaks which have seen a 28.5% increase, driven by an increase in the number of shoppers as well as a surge in frequency of purchase. It has been reported that shoppers are driven by making the most of promotions, as volumes of shoulder roasting joints purchased while on an offer deal increased by 69.1%.

Beef

Over the last quarter, there was an average increase of 19.3% in prices, despite the average price rising, total beef volumes have grown suggesting that beef consumers are now adapting to the new price levels.

The recent growth of beef volumes is in correlation with the increase in convenient beef offerings such as ready meals and easy to cook meals along with an increase in the volume of diced and stewing beef sold in warmer quarters.

FEED

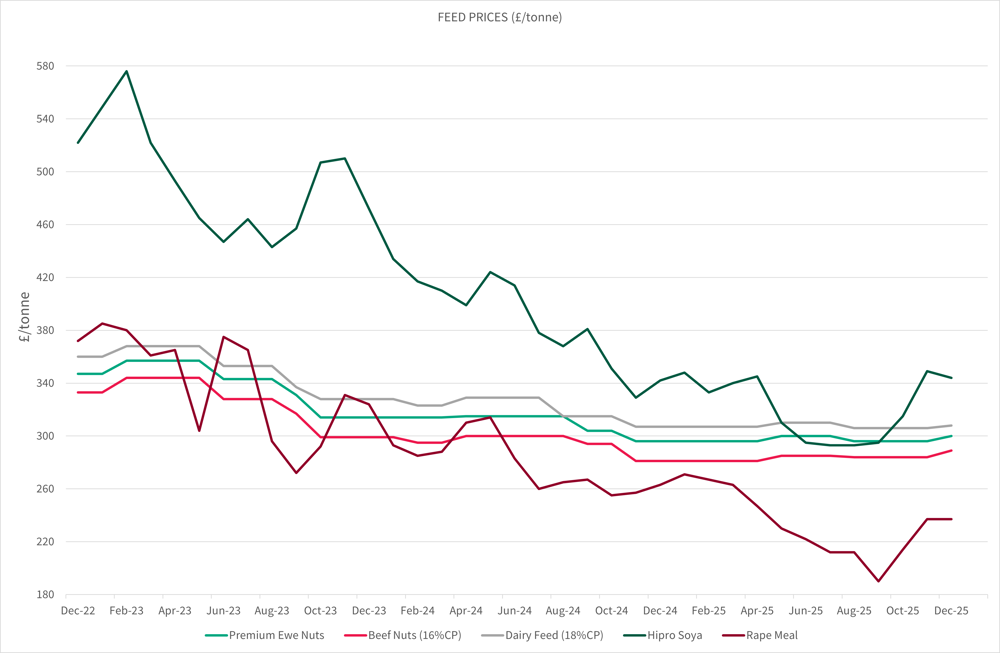

Feed Prices (£/tonne)

Premium ewe nuts, beef nuts, and dairy feed, all remained stable in price with little change across the quarter.

Hipro soya increased by £51/tonne, while Rape Meal began the quarter decreasing with the lowest price at £190/tonne but gradually increased to finish the quarter on £237/tonne. This is an overall increase of £25/tonne from the start of the quarter.

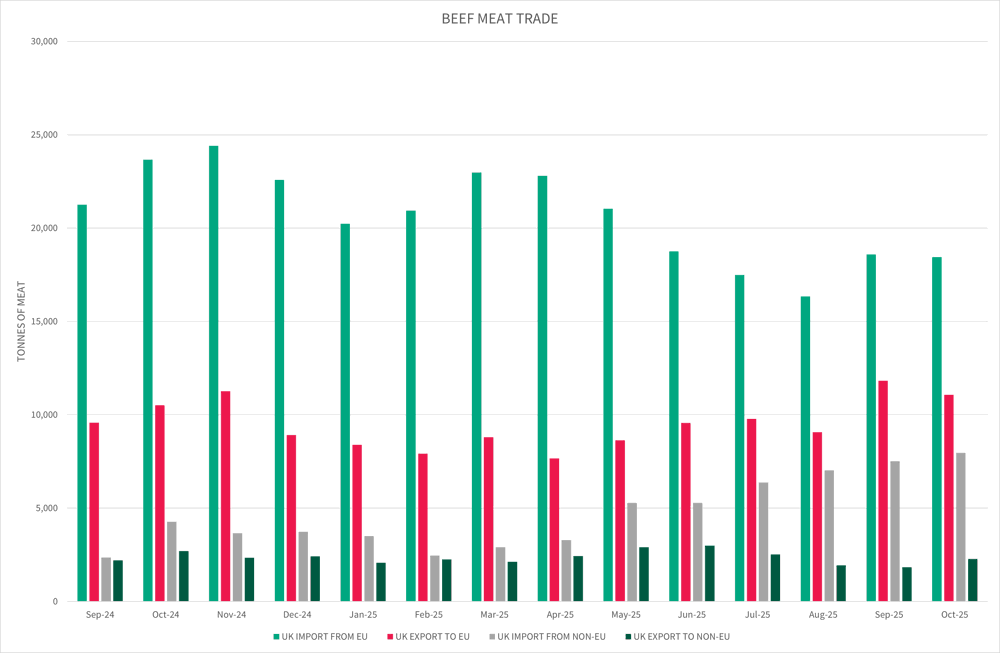

BEEF MEAT TRADE

The most significant difference between October 2024 and October 2025 is UK imports from non-EU countries increasing, with 4,267 tonnes imported in October 2024 and 7,951 tonnes in October 2025, almost double.

Unsurprisingly, UK imports to EU have decreased from 23,657 tonnes in October 2024 to 18,444 tonnes in October 2025. The UK remained a net importer for beef meat in October 2025 with a net balance of 13,050 tonnes.

SHEEP MEAT TRADE

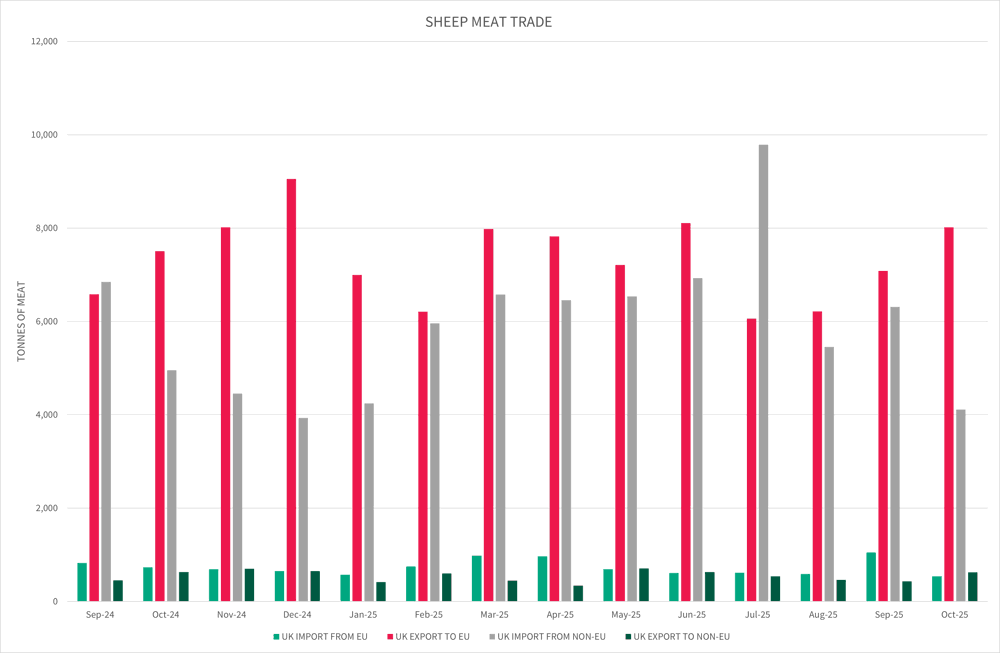

While UK imports decreased for lamb meat between October 2024 and October 2025, UK

export to EU has increased from 7,503 tonnes in October 2024 to 8,016 tonnes in October 2025.

UK export to non-EU remained relatively static, compared to UK import from non-EU which have decreased since October 2024 with 4,952 tonnes to 4,110 tonnes in October 2025. This resulted in the UK being a net exporter for sheep meat in October 2025 with a net balance of 3,993 tonnes.

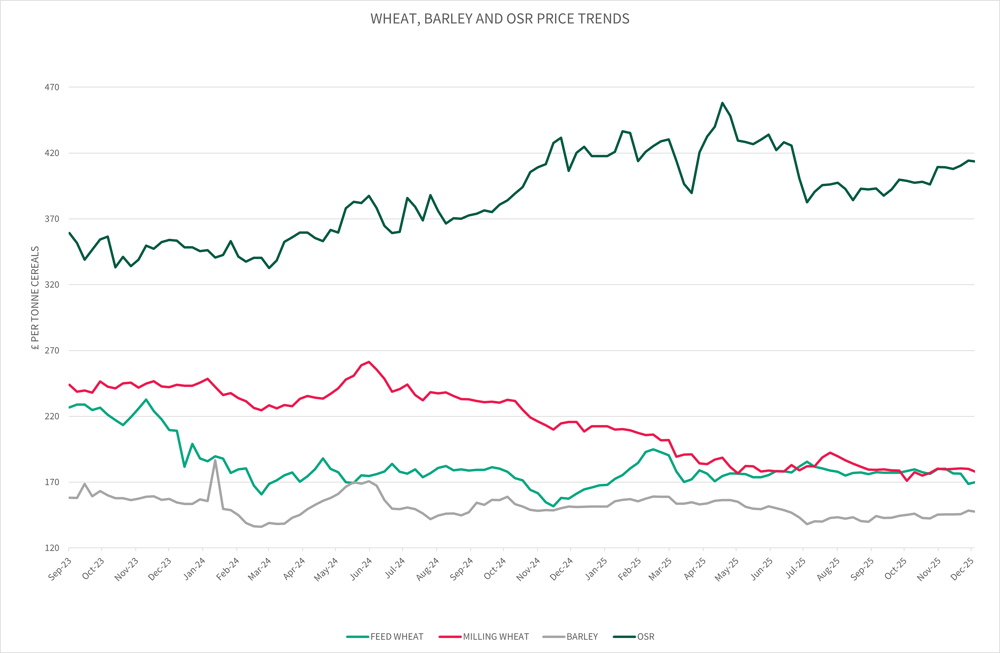

WHEAT, BARLEY AND OSR TRENDS

Feed wheat price has been relatively static, ending the quarter at £164.60/tonne, compared to £162.40/tonne at the end of the previous quarter.

Milling wheat price has seen an overall increase in price, ending the quarter at £182/tonne, with a milling premium of £17.40/tonne.

Oilseed rape has also seen an overall increase across the quarter, closing the quarter at £406.90/tonne, up £8/tonne from the end of the previous quarter at £399.70/tonne.

FUTURES MARKET

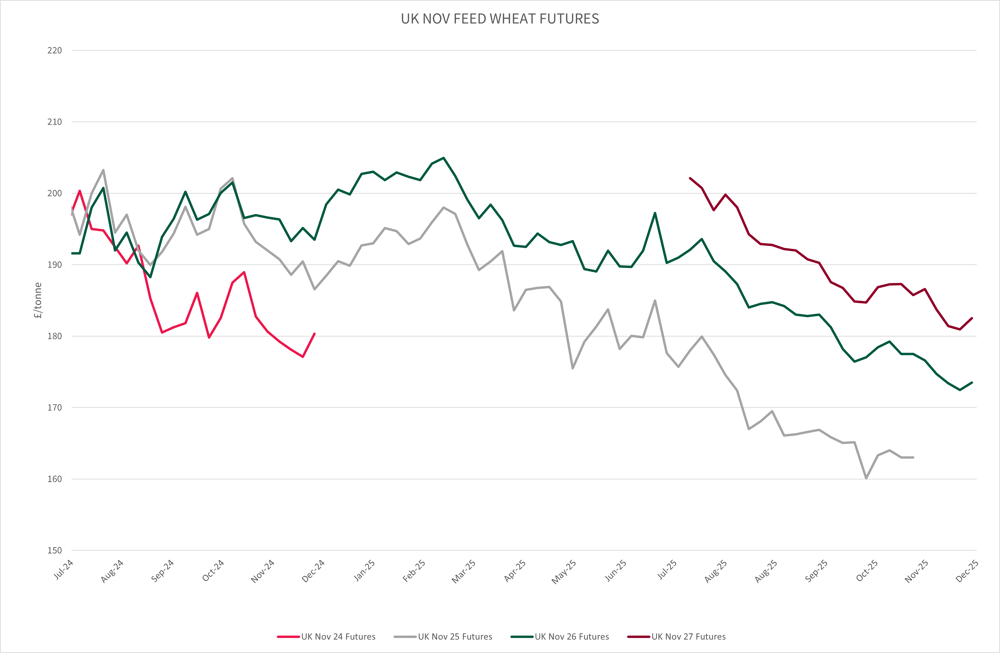

UK Nov Feed Wheat Futures

November 2026 wheat futures continued their trend of falling in quarter 3, closing the quarter on £173.5/tonne, £9.50/tonne down from the start of the quarter.

November 2027 wheat futures also continued to fall during the quarter from £190.25/tonne to £182.50/tonne.

INPUTS

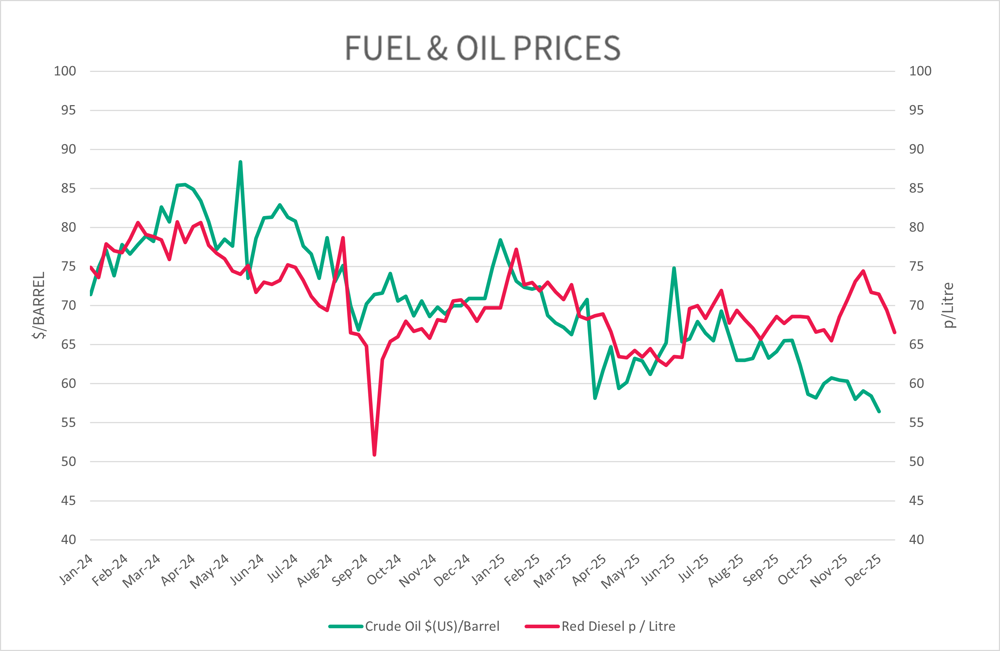

Fuel & Oil Prices

Crude Oil prices have steadily been decreasing, ending at $9.05/Barrel less compared to at the start of the quarter - $65.50/Barrel vs. $56.45/Barrel.

Red diesel saw a decrease of 1.94pence/litre across the quarter ending at 66.56pence/litre.

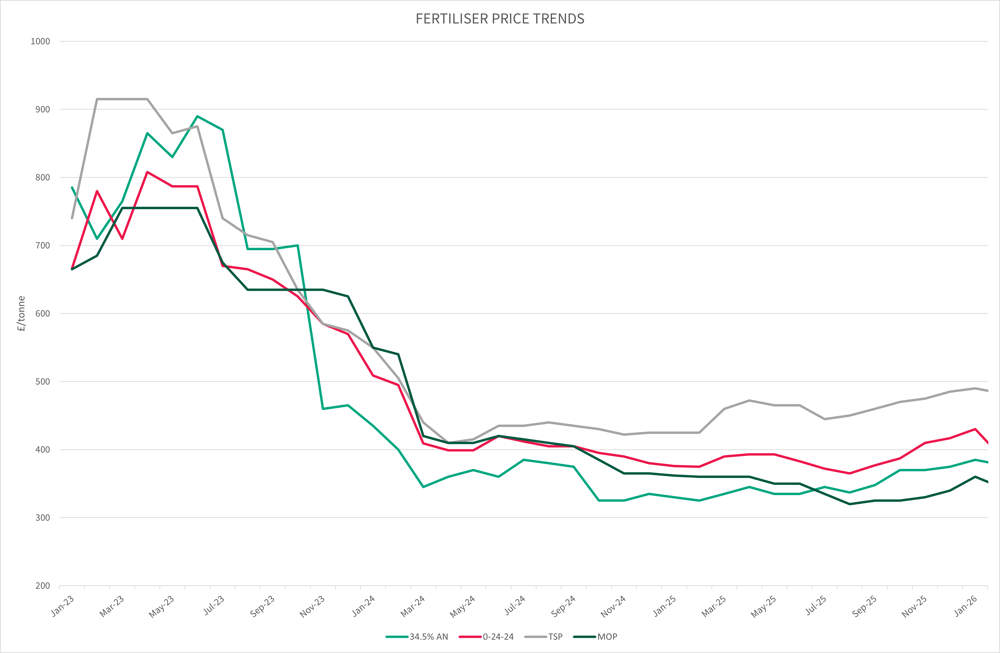

FERTILISER

Fertiliser Prices

Overall, fertiliser prices have been stable, with the majority showing a decreasing trend towards the end of the quarter.

34.5%AN started the quarter on £390/t and ended the quarter at £405/tonne. 0-24-24 has decreased over the quarter by £42/tonne. In the same period, TSP has decreased by £32/tonne to £498/tonne and MOP decreased by £21/tonne, ending the quarter at £349/tonne.

Keep updated

Keep up-to-date with our latest news and updates. Sign up below and we'll add you to our mailing list.

Brown&Co

Brown&Co