Selling land to a developer? What's affecting values?

Fri 24 Feb 2023

Residential land values will be less than they were but I believe the market is stabilising and the current position of the house builders and their view on risk will fall away in the not too distant future."

Nick Dawes, Lincoln Head of Commercial.

If you are selling land to a developer, values have undoubtedly changed, however we believe the market is stabilising and there are more opportunities for smaller and medium sized house builders.

The steadying of house price growth along with issues such as nutrient neutrality causing planning delays and the inflation in build costs has led to a readjustment in residential land values.

Although some of the large house builders are more cautious now than previously when looking at buying development sites, we remain optimistic. We forecast that demand will increase because of the lack of supply, particularly for sites with planning consent - and along with this, prices per acre will rise too.

Values for residential development sites have changed - but the lack of supply will force up prices.

Background

Following the property crash of 2007-8, house prices fell, on average, by almost 19% but from a low of £154,452 in March 2009, the market peaked in 2022 when the average UK house was valued at £294,329 - an increase of 47.5%.

Nick Dawes, our Lincoln office's Head of Commercial, said: "I would suggest a continued rise in value of 14 years is unusual for any market to sustain.

"The Covid period saw consistent property price rises and when cost inflation started to bite, house price inflation continued to outstrip the cost increases. Much discussion was had about the continued rise in values within the industry which focused on not 'when' but 'if' the market would turn.

"On the 6th September 2022 Liz Truss became Prime Minister and announced her now infamous plan to reboot the economy which was the last thing the country needed at the time. The markets took fright and the Bank of England rushed to intervene to calm the volatility. These events were then the trigger for a general property value reassessment along with other markets."

Liz Truss as Prime Minister.

"The first sign of change or readjustment in the Commercial sector was in the 'Big Shed' or industrial warehouse market. With funding costs increasing and exit yields of under 4% seen as too strong, this sector was the first to experience a drop in value.

"As with the increase in funding costs, increases in the mortgage lending terms made buying a house more expensive. We then saw the domino effect - developers started seeing their sales rates decline and needed to offer incentives to counteract this drop-off.

"The consequence was many then walked away from previously agreed land deals of 2022 to pause to reassess the market and take stock in 2023."

The markets took fright and the Bank of England rushed to intervene to calm the volatility."

Nick Dawes, Lincoln Head of Commercial.

The readjustment in development land values - why?

Risk and uncertainty

Nick Dawes said: "The fall in house prices varies from area to area. The Land Registry data from October 2022 to December 2022 shows an overall reduction of only 0.227%. The issue for developers is how much more, if at all, will values fall? Where is the bottom of the market?

In appraising sites to purchase, developers build in a profit margin. This margin will vary depending on a number of factors but risk and uncertainty are taken into account. Where we might have seen 17.5%-18% of gross sale value in 2022, we may now be seeing 20% to reflect this greater uncertainty compared to last year.

Rate of sale

"The rate at which developers sell houses is also an important factor. With such a capital intensive business, the speed of both capital recovery and profit generated are key factors. The slower this happens, expenditure mounts with the cost of running a site not yet completed and the interest payable while capital is tied up.

The first sign of change or readjustment in the Commercial property sector was in the 'Big Shed' or industrial warehouse market. With funding costs increasing and exit yields of under 4% seen as too strong, this sector was the first to experience a drop in value."

Nick Dawes, Lincoln Head of Commercial.

Build cost inflation

"The cost of build has seen a marked rise and for developers who are building out sites acquired pre this inflationary time, they have a significant unbudgeted cost to carry.

These main three factors - involving financial pressure for the developer and associated risk too - are all affecting development land values currently."

John Elliott, Head Commercial Surveyor, also based in our Lincoln office, said: "Increasing house prices over the course of the last 24 months has had an influence on the growth of value in development land. This has been compounded with significant demand outpacing supply with healthy competition between house builders jostling to maintain supply as we progress through a further time of uncertainty.

"However, land value often gets caught in the crossfire of a variety of market forces. A cooling of house price growth, increasing build costs, environmental legislation and planning factors are all contributing to the ultimate price paid to landowners for the ‘bare bones’ of land for development."

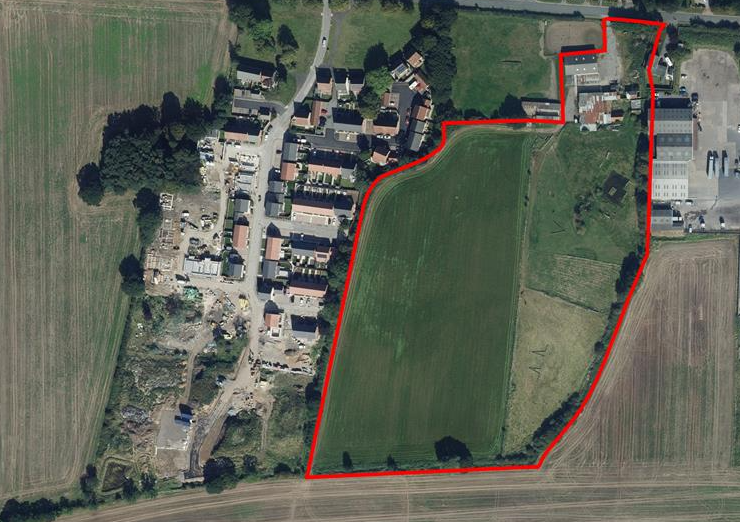

Residential Development Land of 11 acres in the village of Colsterworth, Lincolnshire, Sir Isaac Newton's birthplace, for sale for a guide price of £2million with our Lincoln Commercial office, now sold.

Environmental obligations

Fraser Hall, Head of Architecture & Planning, based in our Norwich office, said: "There have been a raft of environmental initiatives in one form or another finding their way in to planning policy. The most pressing of which is Bio-Diversity Net Gain (BNG) which is now a key requirement for developers affecting the preparation of a major planning project. It became law in November 2022 and will come into effect in November 2023.

"For minor developments, it has been set back to April 2023.

"In essence, the habitat value of the undeveloped land (the development site) must be recreated locally or within the site with a value 10% greater than the original site, secured for at least 30 years. Also, there will be an opportunity to buy credits.

"In addition, there is the Future Homes Standard - the Government's commitment to introduce legal requirements by 2025 that will require new homes to be future proofed with low carbon heating and higher levels of energy efficiency.

"Interim amendments to building regulations came into force on 15th June 2022. These required new homes to deliver CO2 savings of 31% and new non-domestic buildings to deliver CO2 savings of 27% compared to current standards, through a combination of low carbon heating and increased fabric standards.

"The Future Homes Standard will require CO2 emissions produced by new homes to be 75-80% lower than those built to current standards.

"Homes will need to be ‘zero carbon ready’, with no retrofit work required to benefit from the de-carbonisation of the electricity grid and the electrification of heating. Fossil fuel heating (such as gas boilers) will be banned in new homes, with an expected shift to reliance on heat pumps and heat networks."

Developers will need to build homes that comply with the Government's Future Homes standard going forward.

There are some areas of the UK where we have offices, particularly Norfolk, affected by nutrient neutrality and it has significantly delayed new housing consents being granted. We anticipate this is likely to increase the cost of development in order to meet the requirements."

Fraser Hall, Head of Architecture & Planning.

"The restrictions imposed by the Government Agency, Natural England, affect a number of areas of the UK, a condition of which is that development sites must put in place mitigation measures to prove there is no increase in nutrient impact as a result of the development.

"There are some areas of the UK where we have offices, particularly Norfolk, affected by this and it has significantly delayed new housing consents being granted. We anticipate this is likely to increase the cost of development in order to meet the requirements."

While the general market conditions are creating opportunities for the smaller sized housebuilders, nutrient neutrality is having an impact on them, rather than the larger firms.

The Norfolk Broads area is one which has been affected by the nutrient neutrality issue.

Andrew Haigh, Commercial Surveyor, based in our Norwich office, said: "The fact that no planning applications are being granted has not affected the national house builders yet as they tend to have a two year land bank that they are using as a fall back position however if the situation continues they will no doubt be more vocal.

"The small to medium house builders who develop sites with planning for say, between five and 30 houses, are more concerned as they tend to move from one site to the next as they complete one. So, without other sites available, their projected income is uncertain and will inevitably mean they have to let go of workers as they have nothing to build."

Without other sites available, the projected income (of small to medium sized house builders) is uncertain and will inevitably mean they have to let go of workers as they have nothing to build."

Andrew Haigh, Commercial Surveyor, Norwich.

National Planning Policy Framework and the Levelling Up Bill

Paul Clarke, Planner, based in our Norwich office, said: "The Bill currently making its way through Parliament is seeking to introduce a number of changes in planning. A significant change seeks to remove the requirement for Local Planning Authorities to continually demonstrate a deliverable five-year housing land supply, providing its housing requirement in its strategic policies is less than five-years-old.

"Past over-delivery can be deducted from the housing requirement figure in a new plan and there is explicit reference that building at densities significantly out of character with an existing area may be justification for not meeting full assessed needs.

"It gives greater protection for Green Belt land in planning terms through stating such boundaries are not required to be reviewed and altered if this would be the only means of meeting the objectively assessed need for housing over the plan period.

"There is no proposed change to development in the Green Belt and the very special circumstances test and how this is applied to planning applications.

"Essentially this is a Bill to allow local authorities not to have to comply with the five-year land supply - thus reduces the supply of new build housing.

"It should be noted that the Bill is at its committee stage in the House of Lords although it is likely to gain its Royal Assent later this year."

Mr Elliott said: "The Levelling Up and Regeneration policy paper in May 2022 stated that the intention to bring forward legislation to enable the piloting of Community Land Auctions and piloting authorities will pioneer an alternative way of identifying and allocating land for development. This will be in a way which seeks to maximise the potential uplift in value.

"Mechanisms such as Section 106 agreements and Community Infrastructure Levy (CIL) are existing ways of securing contributions derived from development however a formalised ‘land value capture’ could see a major change to the receipt landowners receive for selling their land.

"Land value capture - how uplift in land value from planning policy decisions should be captured for the public purse - aims to help councils raise additional funds to help public infrastructure projects and community investment."

A residential development site at Caistor, Market Rasen, Lincolnshire, for sale for a guide price of £3million, which is under offer with our Lincoln Commercial office.

Mr Dawes said: "In summary, the market is going through a process of readjustment but not anywhere near what it has done historically.

"The mortgage market is stabilising with interest rates currently at 4% which is much higher than we have been recently used to but not as high as historically when we've seen rates reach a high of as much as 17%. There is recent evidence that people are coming back to buying houses with an upturn in enquiries.

"As a result, residential land values will be less than they were but I believe the market is stablising and the current position of the house builders and their view on risk will fall away in the not too distant future.

"There are additional costs coming down the line and build costs will remain higher than they were but we need housing as a nation and if supply is reduced this will increase the value of the existing stock again."

Mr Elliott said: "Demand is still there from house builders for both ‘ready-made’ sites and strategic opportunities. Many local authorities are also in the process of reviewing or preparing new Local Plans to remain well versed with national policy. This process means that councils are reviewing their housing numbers and allocations for development."

For more information please contact Nick Dawes on 01522 457171, John Elliott on 01522 504303, or Fraser Hall and Andrew Haigh on 01603 629871.

Keep updated

Keep up-to-date with our latest news and updates. Sign up below and we'll add you to our mailing list.

Brown&Co

Brown&Co